![]()

Is China Using Tiny Chips to Hack the US?

Follow James on Twitter @jwangARK

In a blockbuster story this week, Bloomberg reported that China has hacked several US companies and government agencies by slipping a tiny chip into computers destined for American server maker, Supermicro. Smaller than a grain of rice, the chip allows hackers to open a backdoor to Supermicro servers, enabling them to steal information from otherwise secure datacenters. Supermicro supplies servers to Amazon, Apple, Facebook, and the Department of Defense, among other companies and government agencies.

In a surprising twist, both Amazon and Apple issued detailed statements refuting Bloomberg’s report. Both assert that they have not found malicious chips inside Supermicro servers and highlight factual errors in Bloomberg’s story. Apple further volunteered that it is not under any gag order and has not signed non-disclosure agreements with any suppliers involved.

The wildly differing narratives suggest the truth lies somewhere in the middle. Perhaps the details of the hack were withheld from upper management, or Bloomberg’s sources exaggerated the extent of any hack. Given the severity of the claims, other sources likely will emerge in the coming weeks to shed light on this important controversy.

Digital Wallets Are Becoming the New ATMs for Financial Services

Follow Bhavana on Twitter @bhavanaARK

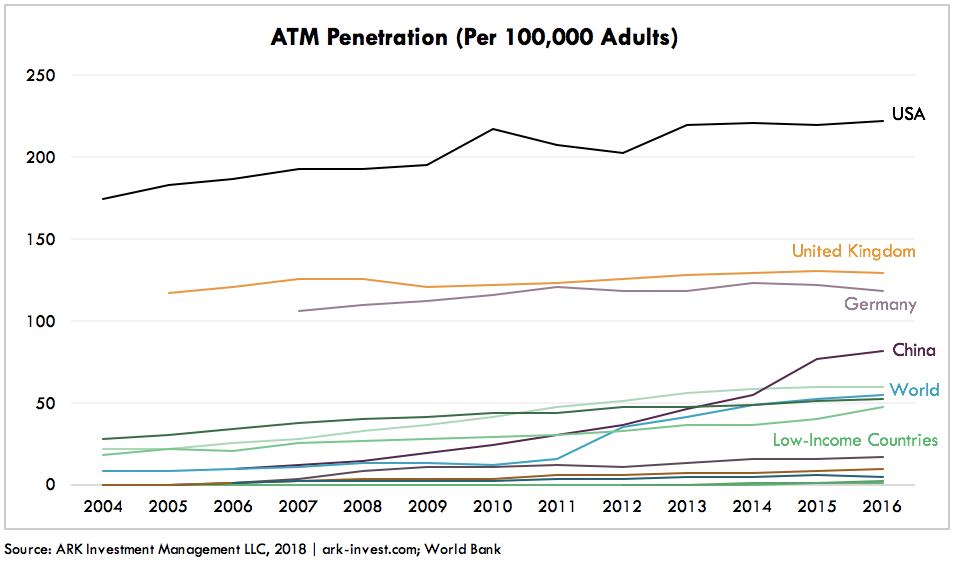

Several decades ago, ATMs emerged as an alternative to bank branches, offering customers easy access to financial services and helping banks to lower infrastructure costs. Their role in retail banking evolved considerably over the years to include check deposits and many information services. Yet, over the last few years, ATM growth around the world has flatlined, averaging 47 per 100,000 adults globally,with the US at roughly 225 and China now stabilizing at fewer than 100.

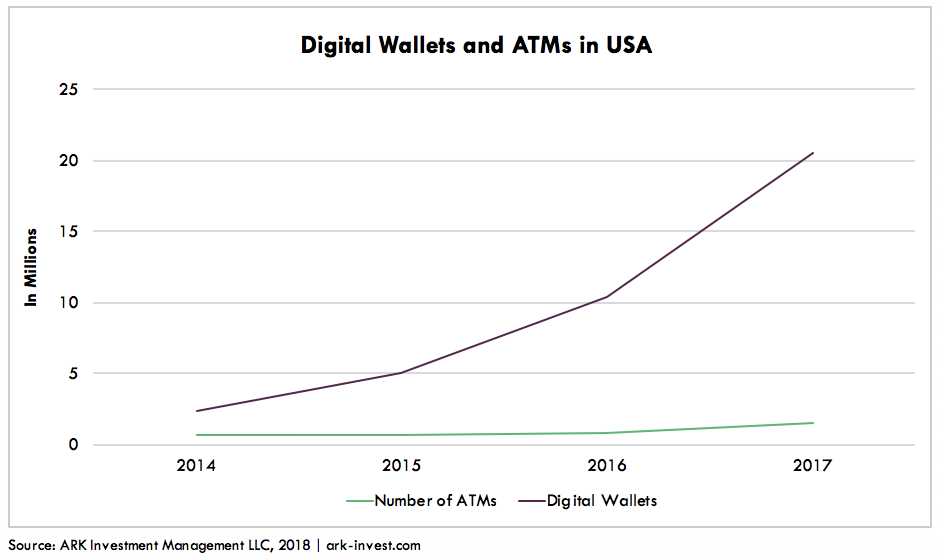

At the margin, digital wallets are taking share today and, eventually, could dominate customer-facing banking ecosystems globally. Wallets like Alipay and Mpesa already are providing access to a wide range of financial services to customers who are difficult to reach in China and Africa. Even with a well-established financial infrastructure in the US, digital wallets are taking off and, at ~20 million today, have swamped the number of ATMs, as shown below.

Miner Equipment Competition Is Escalating

Follow Yassine on Twitter @yassineARK

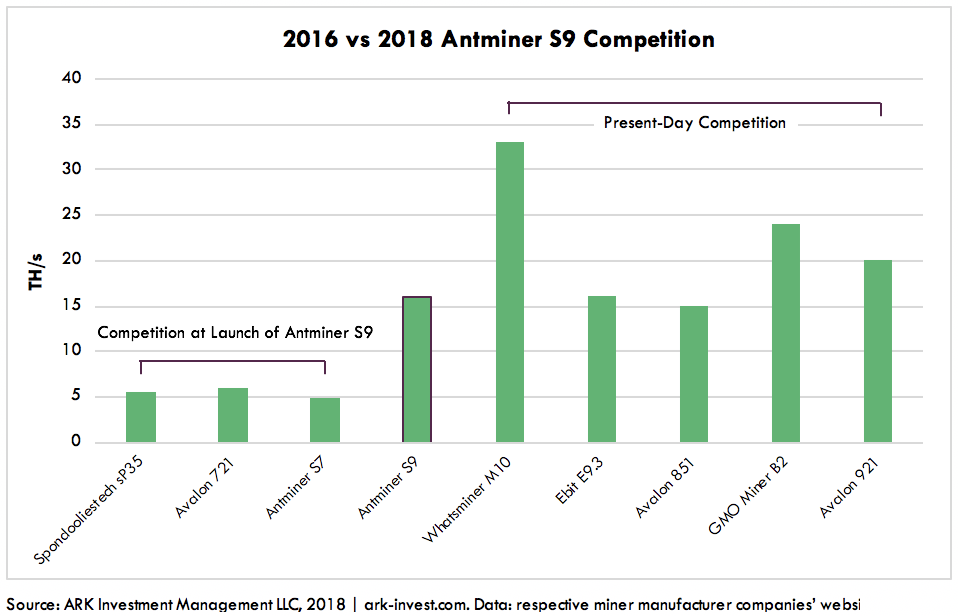

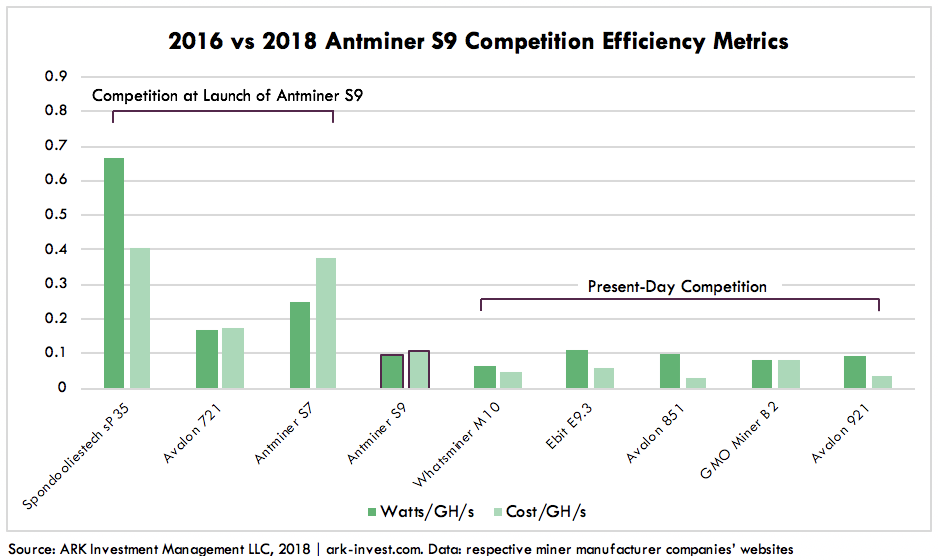

China-based Bitmain launched its last generation of Bitcoin mining machines, the Antminer S9, in 2016, with marginal improvements since then. Recently, it announced plans to roll out its long awaited 7 nm Application Specific Integrated Circuit (ASIC) in a new generation of mining machines at some unspecified time in the future. In the meantime, its competition has escalated considerably, as shown below.

These graphs suggest that its competition has surpassed Bitcoin in both performance and efficiency. In 2016, the S9 had 3 times the hash power of its nearest competitor and was 80% more efficient in terms of both cost and electricity consumption. Today, the Antminer is in the middle of the pack on most metrics.

As Moore’s Law hits its limits and the ASIC design space loses its competitive advantage, the potential for exponential improvements in proprietary production will disappear. Consequently, Bitmain’s machines could continue to lag behind competitors not only in performance but also in cost.