![]()

Media Metrics on Cryptoassets Look Like Those on Internet Stocks at Their Peak, But May Not Be Sending the Same Signal

Follow Brett on Twitter @wintorARK

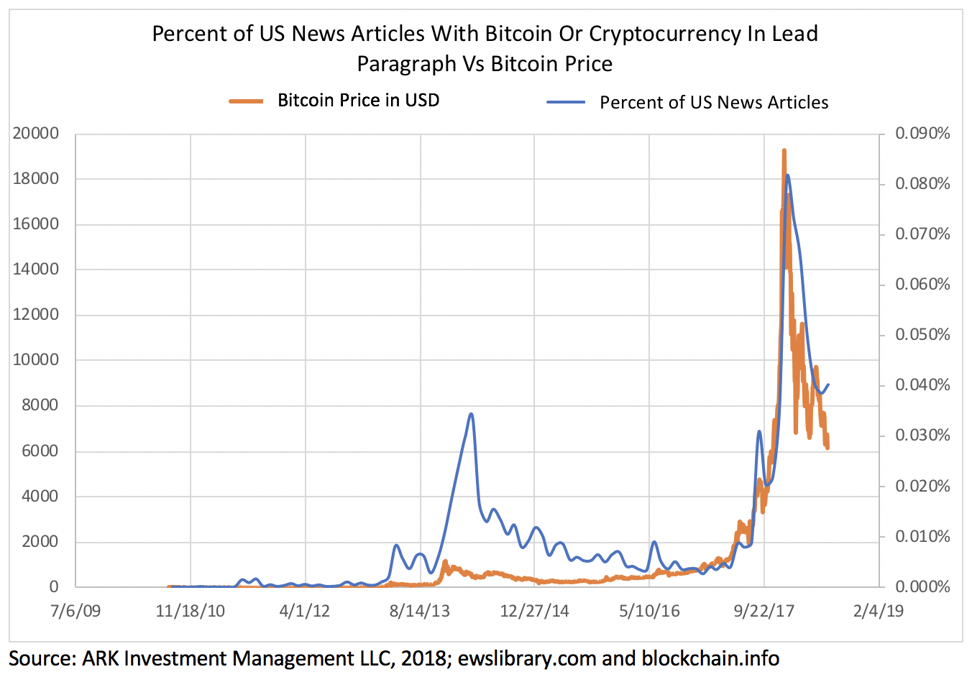

Almost everyone in the US has encountered an article or two, or two thousand, describing bitcoin, cryptocurrencies or blockchain technology over the past 6-9 months. Indeed, the number focused on bitcoin/cryptocurrencies spiked with bitcoin’s price during the fourth quarter of 2017, as shown below. Now that the price and press coverage have dropped sharply, we believe many observers are asking, “Was that it?”

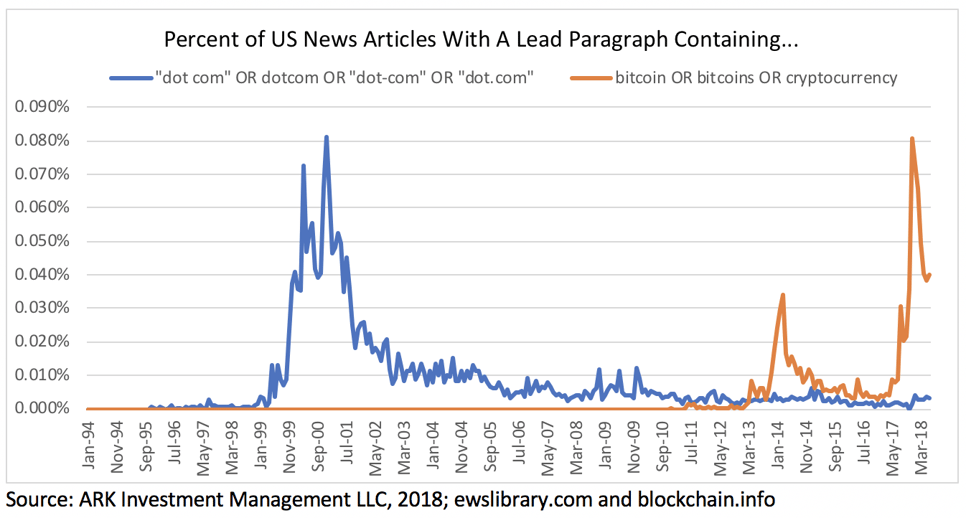

A comparison of this press coverage to that during the last bubble would suggest that cryptocurrencies were in a bubble, and that it has burst. As shown below, the number of US articles focused on cryptocurrencies peaked at roughly the same percent of all US articles as those during the dot com mania. In other words, most business news readers probably learned about the investment “opportunity” in bitcoin last year.

That conclusion falls short, however, as it does not account for differences in the maturity not only of the capital markets supporting dot com stocks and cryptocurrencies but also of the internet and blockchain technologies. The dot com bubble inflated to 6% of global GDP whereas, at its peak, the value of cryptoassets hit only 0.8%. ARK believes that among the primary reasons capital did not follow prices and media attention in the cryptoasset space was the lack of capital market infrastructure, particularly regulatory and legal, which prevented institutional and other broader market participation. During the dot com boom, equity markets were ready and willing to participate, in hindsight too much and too soon. In contrast, the lags in cryptoasset infrastructure development could accrue to the benefit of this new asset class in the long term.

The convergence between price and the utility value of blockchain technologies also helps to explain differences in media mentions between the internet bubble and the cryptoasset ascent. Because “dot com” articles encompassed both the equities and the technology, many focused on the technology and explained the internet services and products themselves. In contrast, because the prices of cryptoassets incorporate the future utility value of an underlying technology that is evolving rapidly, articles tend to focus on price movements on crypto exchanges.

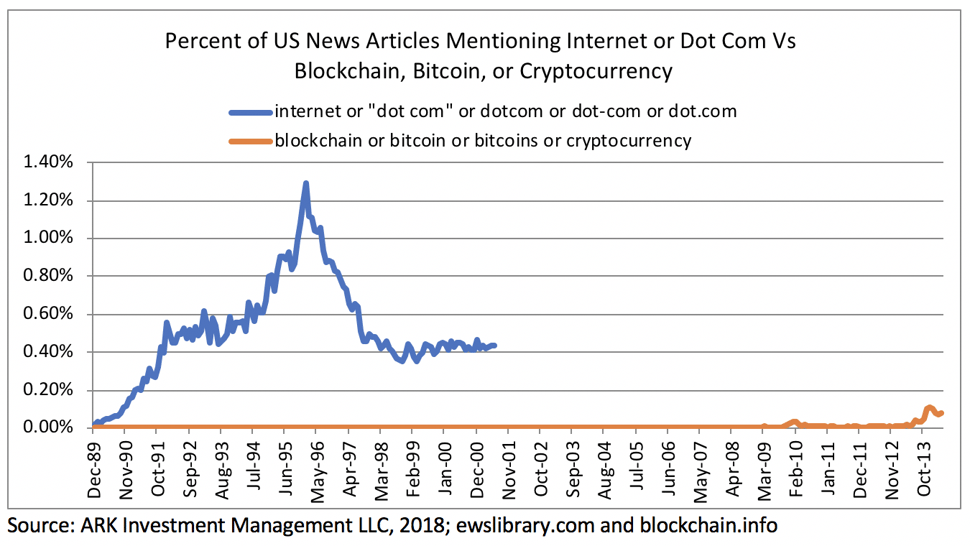

Media mentions including the term “internet” peaked just after the Nasdaq in early 2000, dwarfing mentions of cryptocurrencies seen late last year which, in turn, had not been seen in the internet space since 1994. In that year, interestingly, the first web browser had been in development for just a few years with little clarity on how the technology would proliferate, nor how pervasive it would become…perhaps an apt description of where cryptoassets are on the timeline of development today.

DeepMind Learns to Translate One 2D Image Into a 3D World

Follow James on Twitter @jwangARK

A key difference between human and machine intelligence is that humans have a rich mental model of the world. When we look at a photo, we don’t see a 2D array of pixels: we imagine the full 3D world, understanding the relationship among objects and making useful inferences. For the most part, artificial intelligence (AI) interprets images at face value with no concept of an underlying world. The lack of a mental model is the key reason why AI seems so fragile and limited today.

DeepMind’s latest work is enabling machines to build a mental model of the world. Researchers used deep learning to train an agent inside a 3D game engine to navigate and observe the world from different perspectives. The agent learned the structure of the world with a first-person view, much like a toddler crawling around. After extensive training, the agent learned how to build a mental model of the underlying world from one 2D image. Given a completely new 2D image, it recreated the 3D scene without any additional information.

Being able to transform ambiguous 2D images into rich 3D mental models is an important step in bridging the gap between the brittle AI available today and the common sense of a toddler. If AI continues to improve, the safety and capabilities of autonomous cars, drones, and robots will advance meaningfully.

Chinese Online Banks Are Expanding Their Footprint

Follow Bhavana on Twitter @bhavanaARK

Digitization is coming to mainstream banking services, with internet companies like ANT Financial and Tencent leading the way in China.

MyBank, launched by ANT Financial, is an online bank focused on providing inclusive and innovative financial solutions for small and micro enterprises. Since its inception in 2015, MyBank has facilitated loans online to more than 10 million borrowers, capturing 14% of the 73 million SME market in China and giving ANT an early mover advantage in understanding their lending needs and credit profiles.

Thanks to AI technology, MyBank was the first in China to introduce the “310 Model”: a loan application that takes 3 minutes, an approval in 1 minute or less, with 0 human intervention. ANT is opening this AI platform to 1,000 other Chinese financial institutions, extending its credit offerings to an additional 30 million potential customers.

In contrast, Tencent’s WeBank is focusing on personal and auto loans. WeBank has facilitated US $133 billion in loans to ~12 million consumers. It has embedded micro loan products in its WeChat messaging platform, an important customer acquisition channel, allowing it to operate virtually at costs much lower than those of the bricks and mortar competition.