![]()

Is the Tether Controversy Overblown?

Follow Yassine on Twitter @yassineARK

Tether, a dollar-pegged crypto token which has served as a source of liquidity for several cryptocurrency exchanges, has caused significant controversy during the past few weeks. For some time, critics have asserted that the issuance of Tether has subjected bitcoin to severe price manipulation and now they purport that it might be insolvent and could cripple the cryptoasset markets.

This week, announcements surrounding Tether's unstable banking relationships fueled more speculation, as it reportedly cut ties with Noble Bank, its longtime bank partner, replacing it with HSBC.

At the same time Bitfinex, one of the largest crypto exchanges run by Tether, announced that it had halted all USD deposits. Fear of Bitfinex’s potential insolvency led to a large sell-off in Tether which traded at a large discount to par.

Since then, Tether has recovered strongly, as allegations appear to have been unwarranted according to several reports. In the first report, "USDT [Tether] makes up only 29% of bitcoin’s liquidity while USD makes up 57% and EUR 14%." The second report highlights that Tether used this sell-off to buy back USDT at a discount, profiting from the arbitrage opportunity.

Why Do Banks Continue to Invest in Bank Branches?

Follow Bhavana on Twitter @bhavanaARK

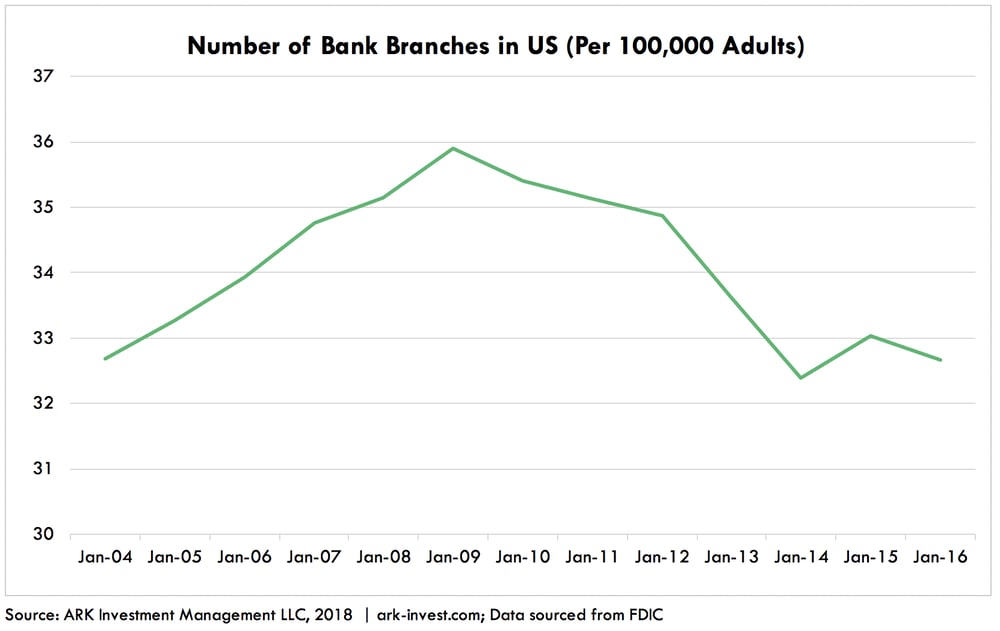

Before the 2008-2009 financial crisis, banks relied on their branches to attract new deposits. Since then and until recently, they have been cutting back, as shown below. Increasing usage of digital channels and rising costs have led to a decline of branches in the US. Recently, however, banks have returned to branch expansion as a go-to market strategy.

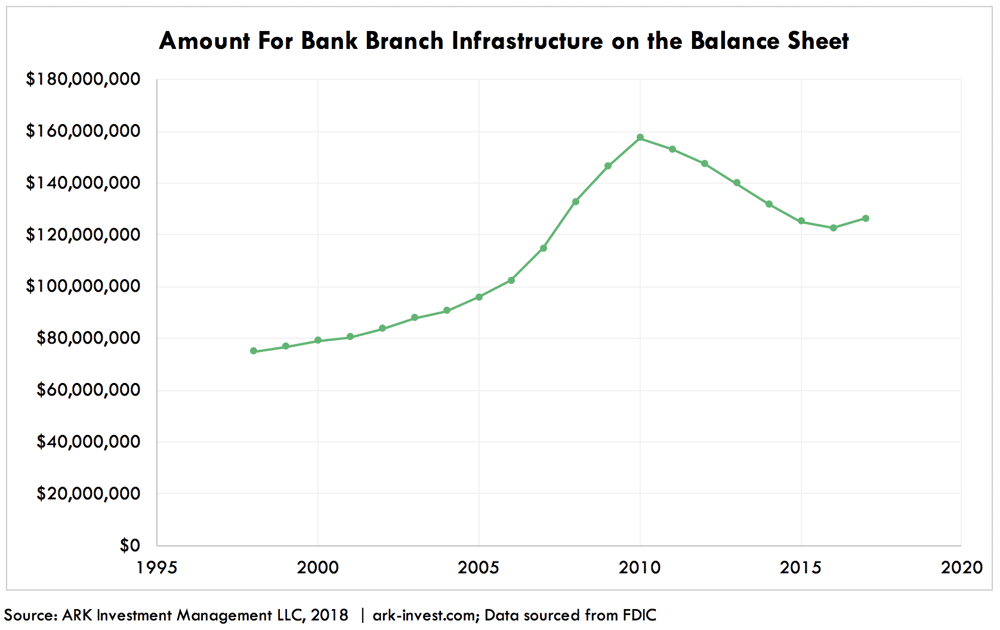

Large banks such as JP Morgan Chase and Bank of America have announced plans to expand by 400-500 branches. FDIC data also illustrates an increase in the buildout of banks’ physical infrastructure, as shown below.

What is motivating banks to increase investment in physical infrastructure? Perhaps they are looking backwards at trends suggesting that higher bank branch shares lead to higher deposit shares.

Offline competitors may be doubling down on physical infrastructure to acquire customers, but digital wallets are taking more share thanks to much lower customer acquisition costs. Banks branches can spend anywhere from $350-1,500 to acquire a customer, while companies such as Square and PayPal pay only $20 and could become a much more effective channel for distribution for banks.

Arm Goes After the Infrastructure Market with Its Neoverse Chip

Follow James on Twitter @jwangARK

Having conquered the smartphone market, Arm now is going after the compute infrastructure market with a new lineup of chip intellectual property (IP) called Neoverse.

Until now, Arm has offered the same chip IP for all markets, whether consumer, enterprise, or industrial. The new Neoverse IP is custom designed to appeal to compute infrastructure markets such as servers, gateways, and cellular base stations. Unlike in the smartphone market, Arm is competing against industry heavyweights such as Intel, Avago, and Cisco, and yet has increased its share of the infrastructure market from 5% in 2011 to 30% today.

Arm’s strategy is straight out of the disruption handbook: start at the low end and move upmarket. As Intel struggles to manufacture 10nm chips and demand for customized, power-efficient processors increases, ARM appears well positioned to capture share.