Bitcoin’s Lightning Network Goes Viral on Twitter

Follow Yassine on Twitter @yassineARK

Twitter CEO Jack Dorsey joined the Lightning Torch Trust Chain, a social media experiment demonstrating the functionality of Bitcoin’s Lightning Network, has gone viral in the last few weeks. As a second layer bi-directional payment channel network, the Lightning Network aims to enable fast and “fee-less” transactions, complementing Bitcoin’s base layer as a settlement layer for large value transactions.

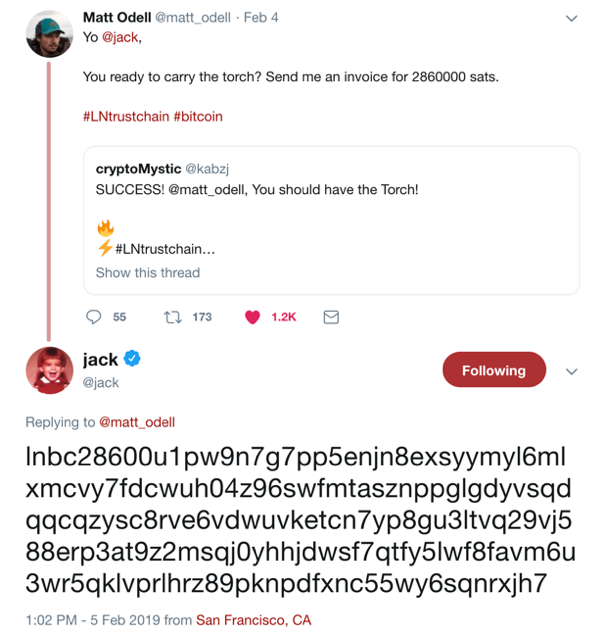

Initiated by Twitter user Hodlonaut, the “Lightning Torch” is a series of Lightning transactions transferred from user to user via Lightning invoices posted on Twitter, as shown below:

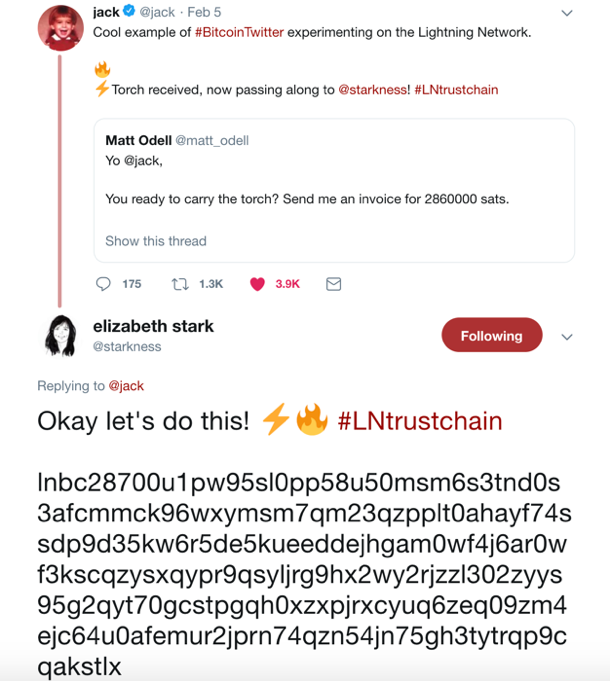

After receiving the torch, Dorsey sent it to Elizabeth Stark, Co-Founder of Lightning Labs:

Dorsey’s participation in the Lightning Network Trust Chain not only validates the Lightning Network’s growing momentum and usability, but also introduces the possibility that its functionality could be integrated into Twitter. After participating in the Lightning Network Torch, Dorsey seemed receptive to incorporating bitcoin tips for tweets, which could enhance the quality of Twitter’s content.

Last year at Consensus and in a recent interview with Joe Rogan, Dorsey stated that he expects the internet to incorporate a native currency, with bitcoin the most likely candidate. Tipping his hat to bitcoin maximalists, Jack also disclosed that bitcoin is, and will remain, the only cryptocurrency he owns.

With Mobile Payment Applications, Consumers Spend More…More Often

Follow Max on Twitter @mfriedrichARK

Mobile value transfers have grown exponentially in recent years from roughly $1 trillion in 2014 to $26 trillion in 2018. ARK estimates they will reach $55 trillion by 2022. Thanks to Alipay and WeChat Pay, China pioneered the market and accounts for more than 90% of global mobile payments today.

A recent study sponsored by the University of Illinois delved deeply into the emergence of the mobile payments market in China from 2010 to 2013, providing some clues perhaps to what could happen in the developed world. Several of their conclusions were provocative. After adopting Alipay, for example, consumers did spend 2.4% more but the frequency of their transactions jumped by 23.5%. Meanwhile, credit cards lost 26.2% of total consumer transaction activity and 40% of total transaction frequency. Impacted the most were transactions up to RMB1000 ($150) in the grocery, entertainment, travel, and other services spaces. In short, the study illustrated that mobile payment applications took share in daily, low- to mid-value, high frequency transactions.

Because the study focused on the early days of mobile payments in a country with low credit card penetration, it might not be an accurate indicator of the disruptive potential of mobile payments in the developed world. It does suggest, however, that the best days for growth in the credit card industry are behind us.

Spotify Doubles Down on Podcasts by Acquiring Gimlet and Anchor

Follow James on Twitter @jwangARK

Spotify has acquired Gimlet Media and Anchor as it doubles down on its audio-first strategy. Gimlet is the podcast production house behind popular shows such as Reply All and The Cut. With Gimlet, Spotify has acquired a team with a proven record in original content production which should enhance its competitive position relative to Apple. Anchor provides easy-to-use software for podcast creation, ad insertion, and distribution, with more than 40% share of new podcasts produced. Anchor’s wealth of data should help Spotify identify and target original content, attracting more users to its ecosystem.

Podcasts should enable Spotify to differentiate its service and reduce its dependence on the music labels. Ever since Spotify’s initial public offering, the bear case has been that it never will deliver attractive returns because the labels will demand an ever-increasing share of its revenues. If its foray into original podcasts is successful, Spotify will convert some of its variable costs into fixed costs, improving its profit margins.

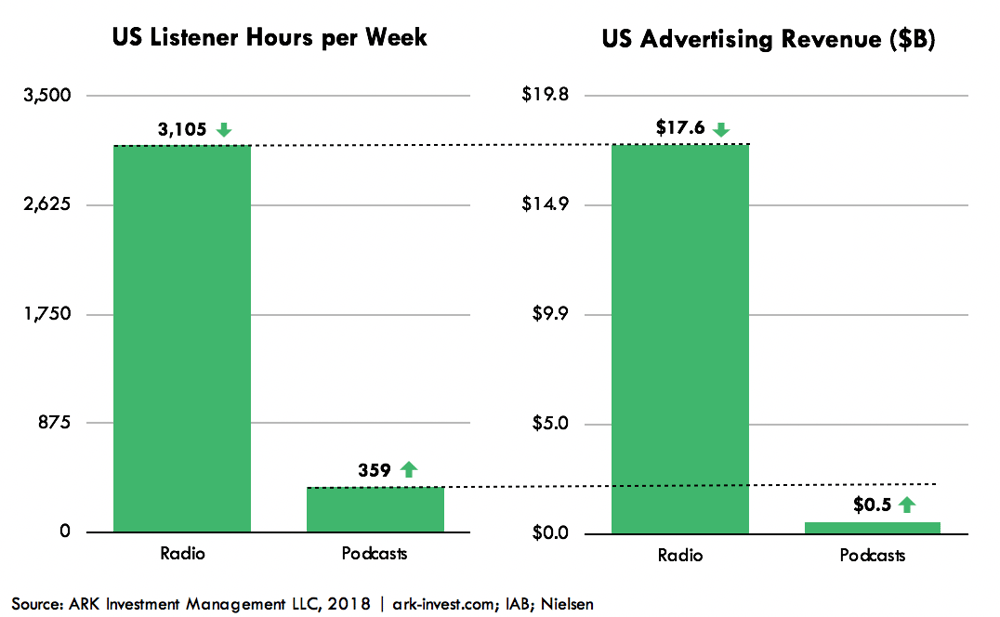

The ad-supported podcast business also is attractive. As shown above, podcast listener hours are roughly 12% those of radio but only 3% of the ad dollars. That gap should close with time. More important, as is the case with TV, traditional radio is in secular decline. A generation from now, podcasts could be the default format for spoken audio. If able to secure a leadership position, Spotify could enjoy a recurring revenue model with much higher margins in the years to come.