Mobile Value Transfer Applications Are Scaling

Follow Max on Twitter @mfriedrichARK

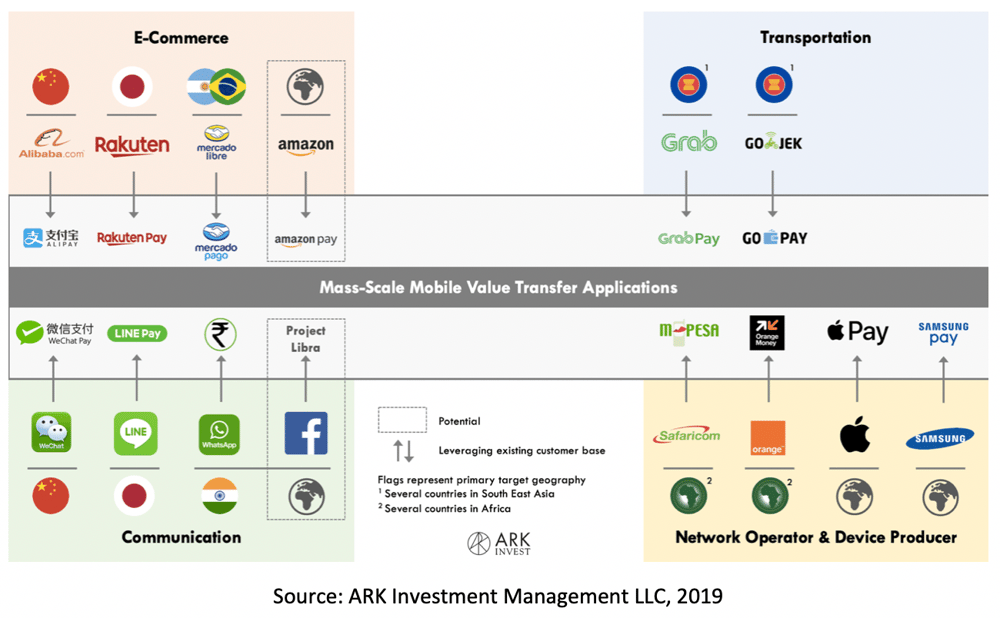

The majority of successful mobile value transfer applications[1] have gained scale by acquiring new users cheaply thanks to large existing customer bases and network effects. For companies without existing users and network effects, scaling will be costly and difficult.

As can be seen in the chart below, many of today’s mass-scale mobile value transfer applications were built on the back of large existing customer bases. From Alibaba in China to LINE in Japan and Grab across Southeast Asia, directing existing users to new products offered by companies they trust has been quite productive.

That said, low customer acquisition costs also can be achieved by network effects, as has been the case with Paypal’s Venmo and Square’s Cash App in the US. Both applications have benefited from low acquisition costs, so much so that Digital Wallet companies such as Venmo and Cash App are able to acquire users for as little as $20.

Mobile value transfer applications that can’t leverage existing user bases often rely on external events or expensive incentive structures to reach scale. India’s adoption of Digital Wallets, for example, gained momentum when the demonetization in late 2016 shocked the economy and galvanized mobile payment platforms, as discussed in this week’s FYI Podcast. Such economic “shocks” are not necessary, however, as illustrated by PayPay, an upstart mobile payment company in Japan that increased adoption with generous cash back rewards.

[1] Includes payments and peer-to-peer transfers via mobile applications

Bitcoin Is Dominating the Cryptoasset Ecosystem Once Again

Follow Yassine on Twitter @yassineARK

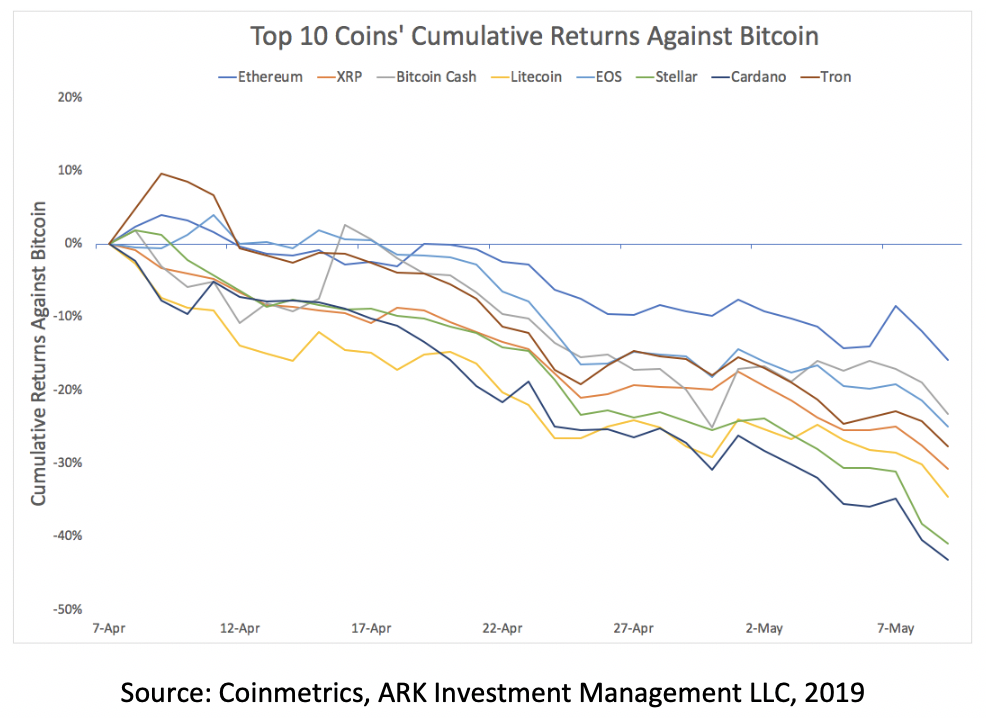

Bitcoin’s (BTC) price pierced $8000 this week for the first time in nearly a year, pushing its market cap to $130 billion and the crypto market cap to $200 billion. As highlighted by Placeholder’s Chris Burniske, the beginning of a bull market often starts with BTC, as the majority of “alts” drop in response to BTC’s role as the main liquidity provider. In the last month, bitcoin’s network value or market cap increased to 60% of the entire cryptoasset ecosystem and 70% of the top 10 cryptoassets. At the same time, the top 10 coins underperformed bitcoin by 30%, as shown below.

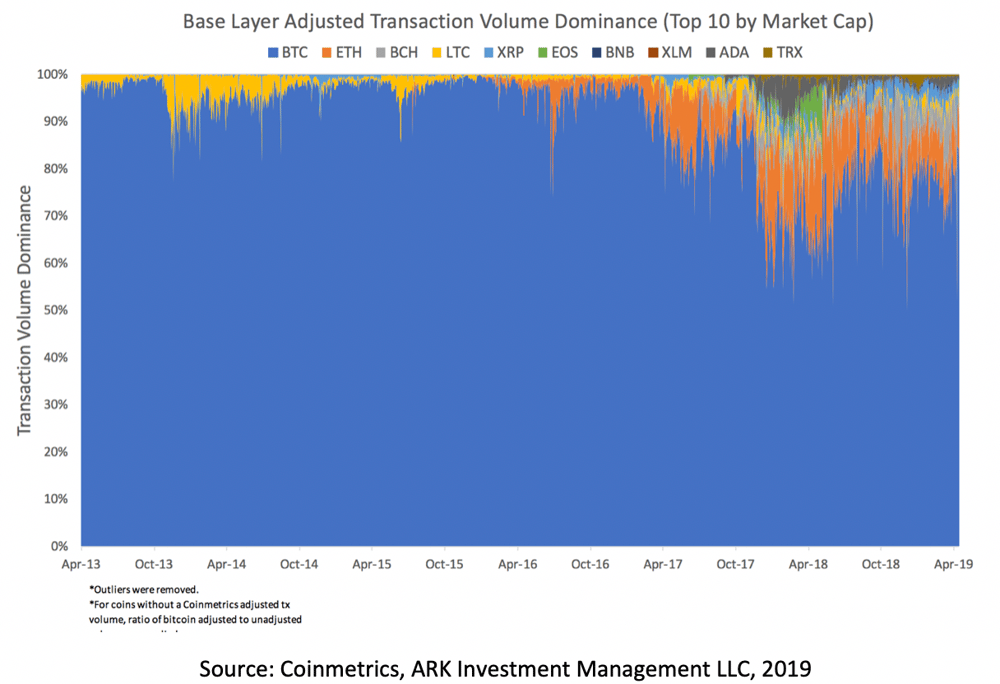

Market cap dominance, however, often skews in favor of less liquid coins as the calculation includes the fully diluted supply of coins, instead of circulating coins. The more relevant metric might be base layer transaction volumes and, as shown below, bitcoin accounts for more than 75% of on-chain transaction volume.

Bitcoin’s apparent dominance of value settled at the base layer should come as no surprise. As was highlighted in ARK Disrupt Issue 139, Bitcoin’s transaction volume surpassed $1 trillion in 2018, twice the volume of Paypal’s network and within an order of magnitude of Visa’s.

The Gig Economy is Big and Getting Bigger

Follow Nick on Twitter @GrousARK

This week Fiverr, an online marketplace for freelance work, filed for an IPO. Founded in 2010 in Tel Aviv, Fiverr is an online platform enabling people to buy and sell digital services as easily as they buy physical goods. Offering services for $5, Fiverr has grown into one of the leading online marketplaces for freelance work. Today, it offers more than 200 service categories and has served millions of customers.

As one of the oldest and most well-established companies in the gig economy, Fiverr has seen increased competition recently. Public since October, Upwork, one of Fiverr’s largest competitors, allows customers to post job listings on which freelancers can bid. In contrast, freelancers on Fiverr post their service offerings, giving potential users choices on the two sites.

The good news for both Fiverr and Upwork is that the gig economy is growing, with plenty of room for both companies. According to one study, freelance work impacts approximately 35% of the U.S working population today and could grow to more than 50% by 2027.