Computer Graphics and AI Will Challenge Human Models

Follow James on Twitter @jwangARK

Source: Engadget

Meet Imma. She has pink hair, loves anime, has over 60k followers on Instagram, and is 100% digital. Thanks to the relentless advancement of computer-generated imagery, a Japanese design agency has created a photorealistic digital model. Imma follows the success of digital Instagram influencer, Lil Miquela, whose hip lifestyle has earned her over 1.6 million followers. What’s remarkable isn’t that these digital models exist, but that people take them seriously.

Currently the images are stills, but soon artificial intelligence (AI) could turn them into talking faces. A recent paper by Samsung shows how a single image can be converted to a “live” video with AI training based on videos of real people talking. Today human writers create the dialogue for these digital models. In the future, however, text generating neural nets such as GPT-2 could take over, feeding other neural nets like WaveNet and delivering realistic sounding speech.

Computer graphics and AI are converging to produce new and disruptive applications. Historically, high end studios had a lock on the creation of realistic digital assets. Soon, AI could empower many people with those superpowers.

What Could be Behind the Vision Fund’s $4 Billion Loan?

Follow Max on Twitter @mfriedrichARK

SoftBank’s $100 billion Vision Fund reportedly is borrowing $4 billion against its stakes in Uber, Slack, and Guardant Health, all of which recently IPO’d. Apparently, the Vision Fund intends to use the proceeds to return cash to investors given the lock-up periods associated with those IPOs.

Surprisingly, SoftBank now accounts for half of all the corporate bonds outstanding in Japan, with the Vision Fund adding another dimension to its leverage. While SoftBank’s $28 billion stake is in equity, outside investors hold both equity and debt: for every $100 invested in the Fund, $38 is in equity and $62 in preferred units. Saudi Arabia’s Public Investment Fund’s (PIF) $45 billion investment in the Vision Fund, for example, is split between $17 billion in equity and $28 billion in debt/preferred.

When Softbank closes the $100 billion Fund, $44.6 billion probably will be in the form of preferred stock and debt. According to several reports, the coupon on the preferred is 7%. Given the Fund’s 12 year life, split into 5 years of investments and 7 years of divestments, the 7% coupon translates into interest payments of $3.1 billion per year, or $37 billion over its life.

Even if it were only to return its capital and cover interest costs, the Vision Fund would have to generate $19.6 billion annually over the 7-year divestment period. If it were to return 10x the original capital, as Masayoshi Son committed to PIF, the Vision Fund would have to generate more than $100 billion per year over the same period. Given this heavy lift, the $4 billion loan might as well have covered coupon payments instead of “returning capital to its investors”.

Instead, the “vision” is growing. Last year, Masayoshi Son announced plans to raise 100 trillion yen, or $880 billion, in multiple Vision Funds over the next ten years. Based on the first Vision Funds I’s equity to debt ratio, SoftBank may have to tap the debt markets for nearly half a trillion USD through 2028.

Bitcoin’s Proof of Work Difficulty Reaches All Time High

Follow Yassine on Twitter @yassineARK

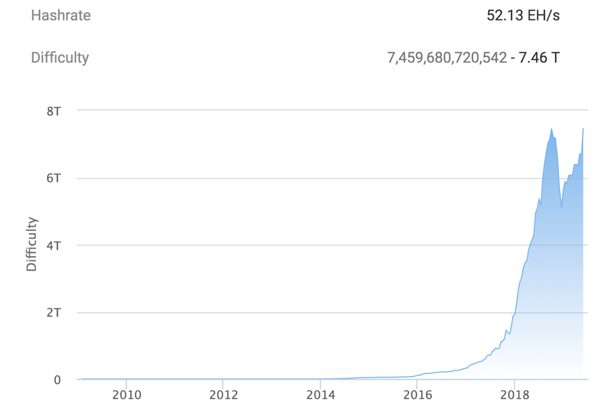

As bitcoin’s price eclipsed $9000 this week for the first time in more than a year, its proof of work difficulty hit an all-time high. Proof of work difficulty is a measure of the difficulty to mine a block. Difficulty is set so that, on average, the hash of a block takes roughly 10 minutes. The biggest determinant of difficulty is the hash rate of the Bitcoin network. Every 2016 blocks, the Bitcoin network reassesses its proof of work difficulty based on the global hash rate to determine whether it is consistent with the network's ability to deliver blocks every 10 minutes. A graph of Bitcoin’s historical proof of work difficulty is shown below:

Source: ARK Investment Management LLC, 2019

In December, Bitcoin's mining difficulty dropped 15%, a rate surpassed only by the 18% drop in November 2011. Initially, the magnitude of the drop created fear that Bitcoin mining had entered a death spiral. Now that difficulty has returned to an all-time high, however, the fear, uncertainty, and doubt (FUD) has been put to rest.

Bitcoin’s price rally this year has been corroborated by the strong fundamentals associated with Bitcoin’s blockchain. For context, hash rate - a proxy for the network’s security - is 6x the level it hit at bitcoin’s peak price of $20,000 in December 2017.

ARK continues to believe that fears of Bitcoin’s death spiral lack substance. Bitcoin’s incentive system minimizes the probability of a mining death spiral, its self-correcting network performing as designed during the past year, as shown in the chart above.