Microsoft Invests $1 Billion in OpenAI

Follow James on Twitter @jwangARK

After changing its structure from non-profit to profit early this year, this week OpenAI received its first major investment, $1 billion from Microsoft. Under the terms of the deal, OpenAI will use Microsoft Azure as its preferred cloud provider and will license its AI technologies to Microsoft, while the two companies collaborate in designing new supercomputing hardware.

For OpenAI, the deal provides cash to recruit talent and buy the AI hardware necessary for training neural networks. This deal not only secures Microsoft as a cloud partner but also gives OpenAI some control in the design of the supercomputers that will be vital to training AI networks.

For Microsoft, OpenAI raises the profile and reputation of its Azure cloud computing platform. Today, AI developers typically select Amazon Web Services (AWS) for its comprehensive cloud tools and Google for its Tensor Processing Units (TPUs). With OpenAI as a customer and collaborator, Microsoft should be able to improve its cloud hardware instances, its AI software offerings, and its reputation among developers.

#SuperCashAppFriday Offers Bitcoin as a Reward

Follow Yassine on Twitter @yassineARK

This week, Square Cash App’s viral customer acquisition strategy expanded to include bitcoin. #SuperCashAppFriday incorporated bitcoin into its giveaways. Users replied to its tweets with their $Cashtags, hoping to be selected as winners by the Cash App’s marketing team. As detailed in Max Friedrich’s recent blog, “Thanks to the Cash App’s viral marketing strategy, Square is acquiring users at a large discount to traditional banks’ cost of customer acquisition.”

This week marks the largest #CashAppFriday giveaway to date: $50,000 worth of cash and bitcoin (BTC), including one BTC to a lucky $Cashtag recipient. All that Cash App users will need to receive BTC is their $Cashtag.

In other words, Cash App’s 15 million monthly active users are beginning to understand how simple it is to send, receive, and deposit bitcoin…all through the Cash App. In fact, the Cash App could become the digital wallet that accommodates not only fiat cash but also cryptocurrencies.

SoftBank Announces Its Second Vision Fund

Follow Max on Twitter @mfriedrichARK

On Friday, SoftBank announced Vision Fund II, a $108 billion late-stage Venture Capital Fund focused on artificial intelligence (AI) startups. According to SoftBank, the second Vision Fund will have at least 13 Limited Partners (LPs) besides SoftBank, including US tech giants like Apple and Microsoft, Japan’s largest banks, and Kazakhstan’s sovereign wealth fund. According to the initial LP list, Saudi Arabia’s Public Investment Fund (PIF) and Abu Dhabi’s Mubadala Investment Company are not participating in Vision Fund II, after accounting for $65 billion of the $100 billion raised for Vision Fund I (VFI). As Softbank was deploying VFI, PIF voiced concerns about the outsized valuations of its deals.

Yet to be disclosed is whether or not Softbank will structure Vision Fund II like Vision Fund I, requiring investors to put up 62% of their contribution in debt yielding 7%. Now, VFI has to pay $3.8 billion in interest per year for the 12-year life of the Fund. Interestingly, when Uber went public a few months ago, SoftBank’s capital gain was $1.9 billion, not all of which has been realized, just half of the interest it will pay to its Vision Fund I partners this year. Now, Vision Fund I reportedly plans to take out a $4 billion loan collateralized by the positions in its portfolio.

Perhaps to avoid debt this time, Softbank seems to be including more LPs and urging its portfolio companies to support them. In its pitch to Microsoft, for example, Softbank apparently said that it would name Azure as the Vision Funds’ preferred cloud partner. Earlier this year, it entered a strategic partnership with Wirecard, the German payments company, which soon thereafter announced a deal with a Vision Fund portfolio company. With this strategy, SoftBank seems to be enabling portfolio companies to scale globally more efficiently and effectively.

“Alexa, Play Amazon Music”

Follow Nicholas on Twitter @GrousARK

According to a recent report by The Financial Times, this past year the number of Amazon Music paid subscribers grew 70% to 32 million. The rapid growth of Amazon Music has caught the industry off guard, as it seemed that Spotify and Apple would dominate music streaming, with 100 and 60 million paid subscribers, respectively.

Launched in 2016, Amazon Music Unlimited seems to have only one competitive edge, distribution. Other than distribution, the three competitors have priced their seemingly similar services competitively. Amazon’s distribution - Prime Members and Alexa speaker owners - is its primary competitive advantage. For example, Amazon Prime members, now more than 100 million in the US, have access to Prime Music at no cost as well as a freemium option and Amazon Music Unlimited at a discount.

Perhaps more significant is Amazon’s dominant control of the booming smart speaker industry in the US. With roughly 60% share, Alexa includes Amazon Music as the default music streaming option. To capitalize on its leading position in speakers, Amazon recently began offering an “Alexa Only” option for $4 per month, a low cost, frictionless way to listen to music, as most users already have payment capabilities linked to their devices.

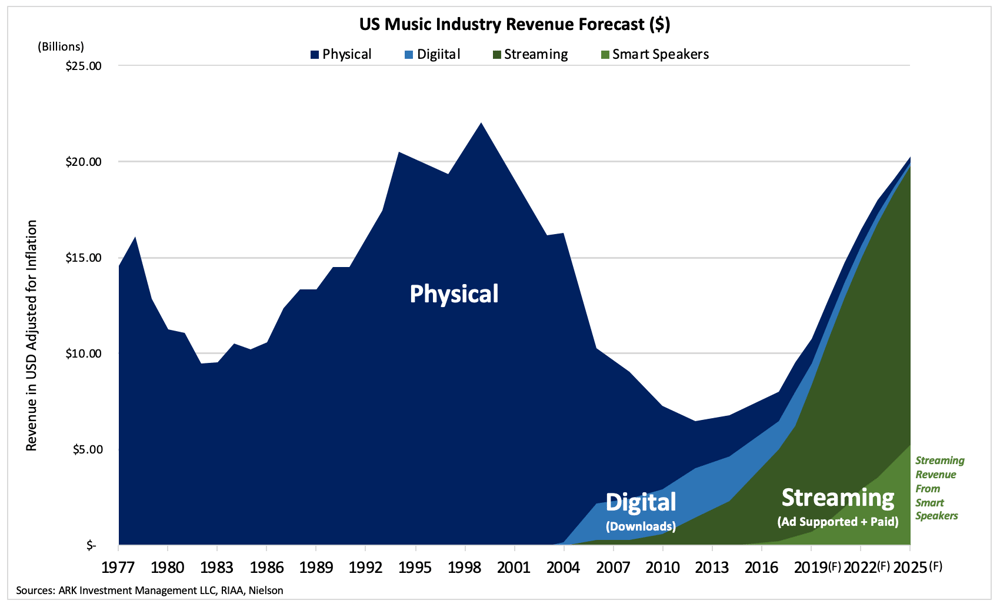

Amazon’s ability to leverage its Prime ecosystem and Alexa smart speaker user base should continue to drive its growth in streaming music, a market that seems to be entering S-curve territory. ARK believes that US streaming music could push total music sales back to $20 billion for the first time in 25 years in 2025, as shown in the chart below, and that one of the main customer acquisition channels could be smart speakers.