Internet Advertising Is the Megatrend that Refuses to Die

Follow James on Twitter @jwangARK

About a year ago, we published a piece pointing out how industry analysts have underestimated the potential for internet advertising consistently and suggesting it could grow 17% per year from $280 billion in 2018 to $610 billion by 2023. At the time, eMarketer was predicting 15.8% growth for digital advertising in 2019, but in February it upped the estimate to 17.6%. Although a move in the right direction, this estimate still seems too conservative and could be under water by the end of the year.

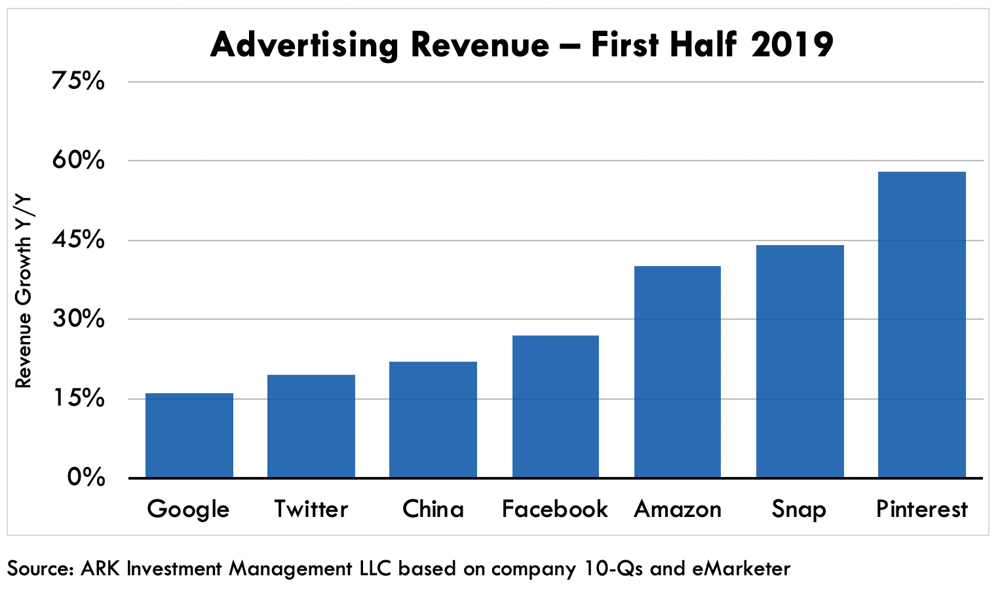

Two quarters into 2019, most of the key internet advertising players have reported more than 20% growth in advertising revenue on a year over year basis.[1] The exception is Google, which accounts for about 40% of internet advertising, but its growth accelerated from 15.3% in the first quarter to 16.1% in the second.[2] Despite its bad press, Facebook grew advertising revenues 27% on a year over year basis while newly minted public companies like Snap and Pinterest posted more than 40%.

After evolving during the past two decades, internet advertising shows few signs of old age. Google’s and Facebook’s continued growth is testament to internet advertising’s superior value, measurable ROI, and ease of use. New formats illustrate that Pinterest and Snap, among others, are enhancing online advertising opportunities and extending its trajectory.

[1] Based on company quarterly results.

[2] Note: This is the ad segment, not Alphabet total.

Bitcoin’s Transaction Fee Revenue Is Approaching $1 Billion

Follow Yassine on Twitter @yassineARK

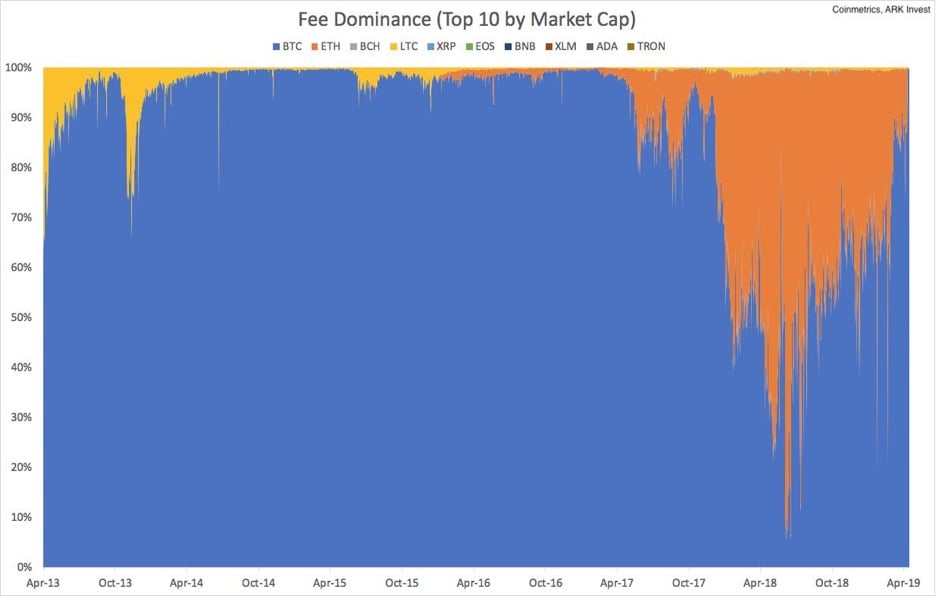

Bitcoin is closing in on $1 billion worth of transaction fees generated since inception, as first highlighted in a report released by Coinmetrics. Among the top 10 cryptoassets by market cap, its share of revenues generated by fees dominates at ~90%, as shown below.

Also shown, the reverse was true during the summer of 2018: Ethereum (ETH) generated 90% of fee revenue and Bitcoin (XBT), 10%. Among the reasons that ETH fees were so high last year were fee mining on exchanges like Fcoin and the popularity of mass airdrops.

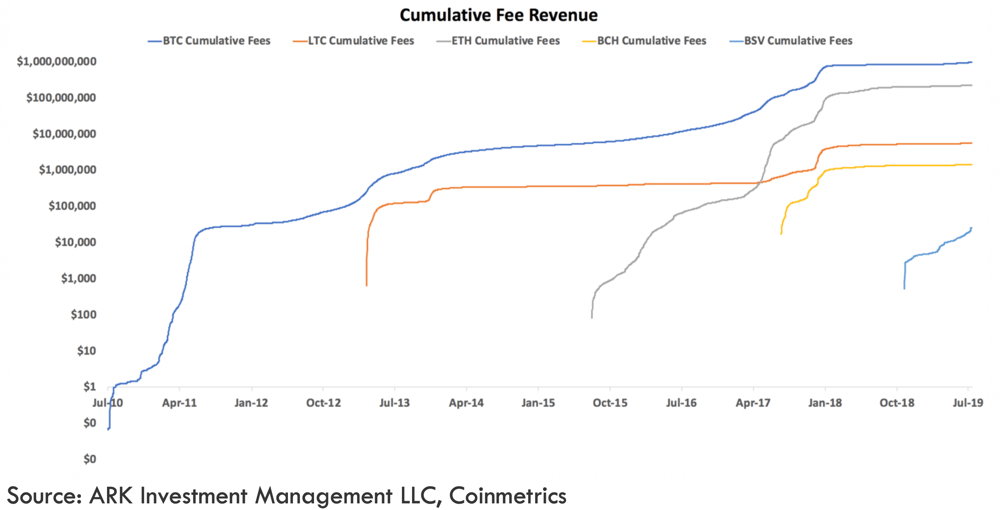

Today, Bitcoin and Ethereum are the only two cryptonetworks generating meaningful fee revenue. Bitcoin’s cumulative fee revenue stands at $950 million, equivalent to 7% of its total miner revenue, while Ethereum’s stands at $225 million, equivalent to 3.75% of its total miner revenue, as shown below.

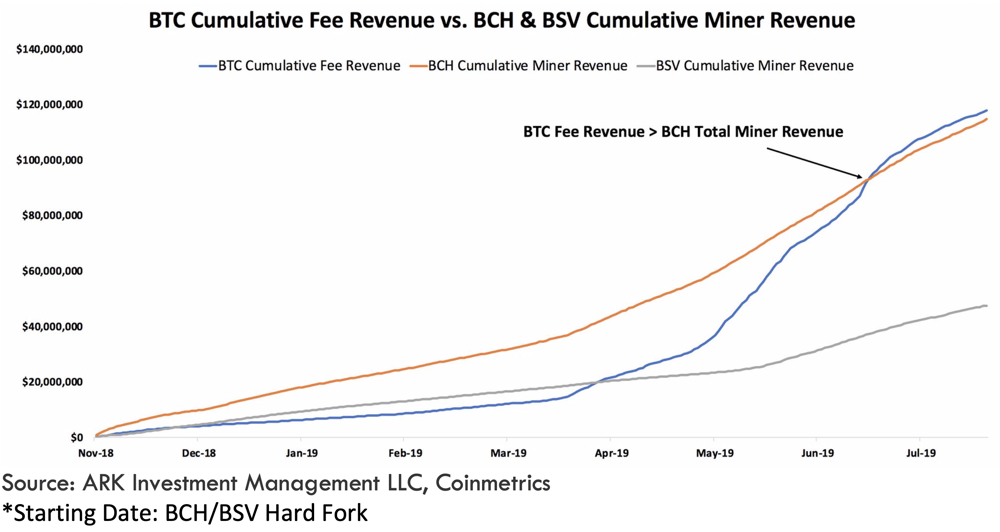

Other cryptonetworks like Bitcoin Cash (BCH) and Bitcoin SV (BSV)are generating substantially less miner revenue. Bitcoin’s transaction fee revenue alone, which as previously mentioned only accounts for 7% of its total miner revenue, is greater than BCH’s and BSV’s combined, as shown below.

Square Secures Instant Payroll Patent

Follow Max on Twitter @mfriedrichARK

On July 2, Square (SQ) secured a patent that enables Square sellers’ employees to receive instant access to their salary, possibly directly via Cash App, Square’s consumer platform.Wage checks can take two weeks to hit workers’ bank accounts explaining why, according to the FED, 40% of Americans are not able to cover an unexpected $400 cost. Payout delays are one of the main reasons that the $40 billion payday loan industry exists, a space in the financial services industry that now Square is targeting squarely.

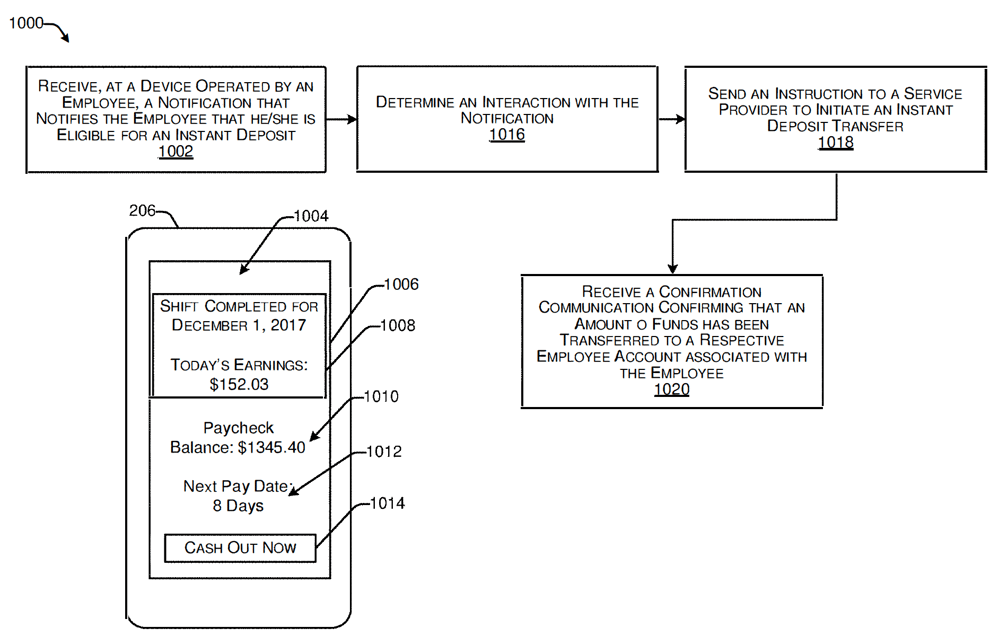

In the patent, Square outlines how a ‘service provider’ will offer eligible employers cash advances so that they can disburse wages instantly to eligible employees. As shown in the chart below, an employee would receive a notification and payment on her smartphone, potentially at the end of each work day. Square plans to use machine learning to determine the level of reliability of both the employer and employee. It will incorporate and monitor the length of time an employer has been in business, its account balances, chargebacks and fraud, and inventory, among other factors. To gauge the reliability of employees, Square will incorporate and monitor the employee’s history with an employer as well as his work schedule and adherence to it, among other factors. Square’s algorithms will determine not only the eligibility but also the amount that an employer will be able to borrow and disburse to an employee.

Because it already offers its sellers payroll management services, Square is in a good position to offer other financial services to both employers and their employees given its information advantage. Indeed, its consumer platform, the Cash App, could continue to facilitate the convergence of two powerful ecosystems: merchants and consumers.