Google Searches Illustrate the Rise of Square’s Cash App Over Time

Follow Max on Twitter @mfriedrichARK

Our previous research showed that Square’s Cash App is especially popular in southern US states these days. Comparing the Cash App’s Google Trend data to that of Venmo during the past four years, we can see that Cash App gained significant share in the south during the second half of 2017, as shown in the GIF below. (Click here if your email client does not load the GIF.)

Cash App seems to have surged in response to several product launches and marketing efforts in 2017. In May 2017, Square launched Cash Card, a prepaid debit card that enables users to spend their Cash App balances and, later in 2017, it enabled Cash Card to withdraw money at ATMs. In November 2017, Cash App allowed users to buy and sell bitcoin with no fees.

Importantly, Cash App also launched Cash App Friday, a weekly marketing campaign with prizes, in August 2017. Our research suggests that Cash App Friday has been highly effective in acquiring new users.

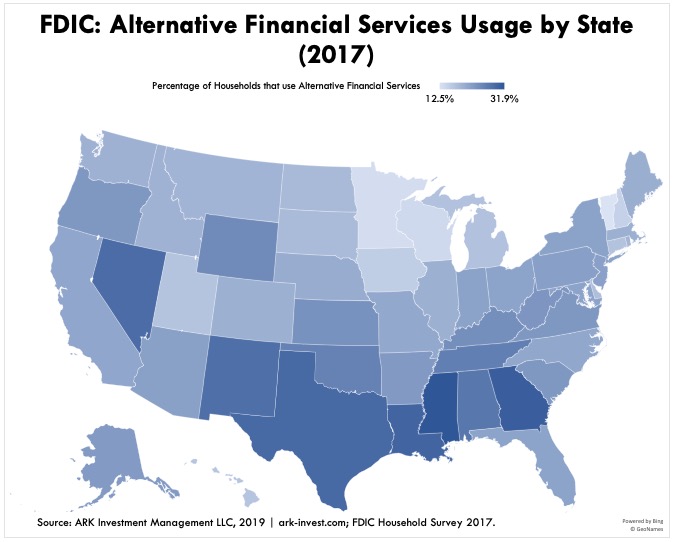

Not surprisingly, in 2018 reports surfaced that Cash App was gaining traction in lower income cities like Atlanta with high unbanked rates. Jack Dorsey, Square’s CEO, has said that “People are using [the Cash App] as their primary banking account, and in some case it’s their only bank account.” Our previous research illustrated the striking geographical overlap between Cash App adoption, as measured by Google searches, and the FDIC’s unbanked rate. Cash App’s adoption by geography also matched the FDIC usage rates of Alternative Financial Services like money orders and payday loans, as shown in the chart below.

While Cash App already is a $500 million revenue run rate business, it should continue to scale given the 20 million people still unbanked in the US, not to mention the rest of the world.

Stripe Could Disintermediate Traditional Lenders with Its New Financing Product

Follow George on Twitter @ARKInvest

Stripe, an online global credit card processor, formally launched a well-telegraphed financing product on Thursday. One of the biggest obstacles small businesses face as they grow is access to financing. Stripe’s new service not only increases access to financing but also simplifies the process.

Traditionally, to get loans small business operators had to travel to bank branches, fill out paper applications, and provide copies of their financial histories. A few days or weeks later, loan officers would render their decisions, offering little insight into the decision-making process.

Among companies including Square, Stripe Capital has flipped this process on its head. With real time access to data on credit card transactions and payments, Stripe has a window to the health of businesses and can offer financing options, sometimes before businesses even apply, often dispersing the funds online within 24 hours.

Customer acquisition costs are a key consideration in making business or consumer loans. During the second quarter, Square facilitated 78,000 loans averaging ~$6,800 per loan. It appears that many of its loans were under $5,000, a threshold most lenders avoid because their costs exceed returns.

We are cautiously optimistic about Stripe Capital, because it is upselling existing customers instead of acquiring new customers, as is Square. Stripe’s customers generate transaction volumes that skew much higher than Square’s, however, inviting much more competition into the process.

Facebook Dating Launches in the US

Follow James on Twitter @jwangARK

Facebook is getting into the dating game. Facebook Dating is an extension of the Facebook app that helps people find a romantic partner. Having been tested in a number of countries, the feature launches officially in the US this week.

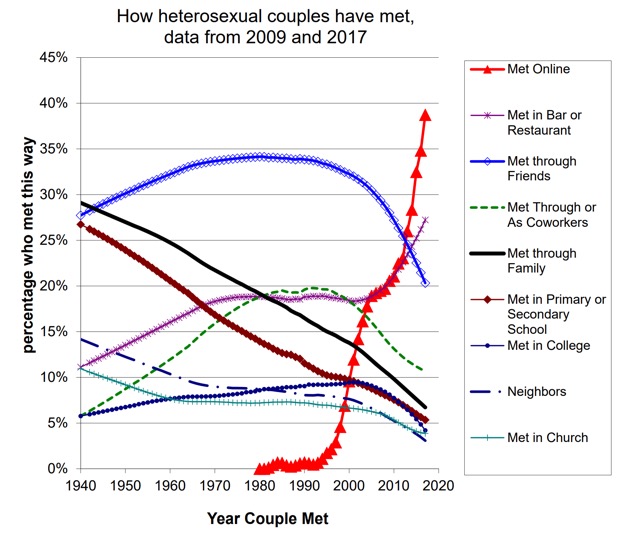

The mobile internet has transformed the way that couples meet in the US. The percentage of couples who meet online has soared toward 40% while the percentage meeting through friends, work, or family has plummeted over the past three decades, as shown below. As a result, the market for dating apps has burgeoned. Owned by IAC, the Match Group, which hosts more than 45 dating apps including Tinder, OkCupid, and Hinge, generates close to $2 billion in revenue.

Source: https://web.stanford.edu/~mrosenfe/Rosenfeld_et_al_Disintermediating_Friends.pdf

Source: https://web.stanford.edu/~mrosenfe/Rosenfeld_et_al_Disintermediating_Friends.pdf

Relative to Facebook’s $60 billion in revenue, $2 billion pales. So, why is Facebook focused on dating? One possibility is that the total available market (TAM) for dating today is vastly under-penetrated. With access to Facebook and Instagram histories, Facebook should be able to create more compelling user profiles and suggest better matches. Today, Facebook is monetizing its North American users at more $100 per year, a metric to which dating could add a new dimension.

Bakkt Opens a Custody Warehouse in Preparation for Bitcoin Futures

Follow Yassine on Twitter @yassineARK

Last week, ICE-owned Bakkt launched its custody warehouse, bringing it one step closer to debuting the first physically-delivered bitcoin futures. Opening its custody warehouse will allow ICE’s customers to make deposits and withdrawals in preparation for the launch.

The introduction of physically delivered bitcoin futures is a positive for the bitcoin space. While not the first bitcoin futures contract, Bakkt’s is the first with physical bitcoin delivery. In August, the New York State Department of Financial Services gave Bakkt regulatory approval to create the Bakkt Trust Company, a qualified custodian, and the Bakkt Warehouse to custody bitcoin for physically delivered futures.

As Bakkt states, “The availability of physical delivery brings more flexibility in managing bitcoin exposure.” Unlike cash-settled contracts, physically-delivered contracts will allow customers to receive the actual bitcoin when contracts expire, enabling a more transparent price discovery mechanism and suppressing spot market trade manipulation heavily criticized in the past.