Square Cash App’s New Stock Trading Feature Highlights Overvaluation in the Private Fintech Market

Follow Max on Twitter @mfriedrichARK

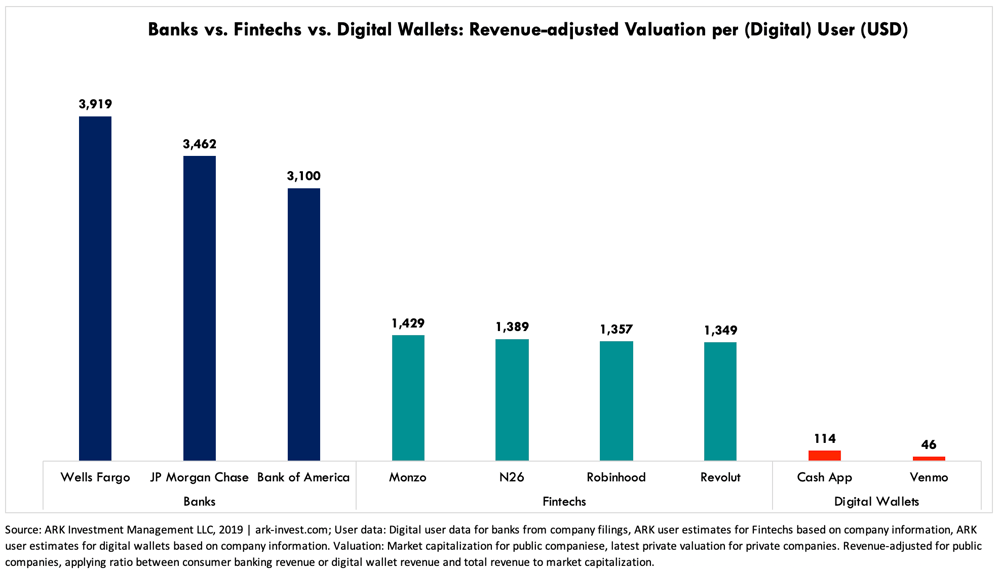

Cash App is testing a new feature that would enable users to trade stocks at no cost, much like Robinhood’s free app, according to Bloomberg. While Cash App and Robinhood might offer similar features and functionality, the wide gap between the valuations of Square and Robinhood would suggest otherwise: based on its last round, venture capital companies have funded Robinhood at approximately $1300 per user, while the public equity market seems to be valuing Cash App users more than 90% lower at roughly $120.1 Also interesting to note, at the end of the second quarter Cash App’s active user base was 23 million2 compared to Robinhood’s estimated 5 million.3

In other words, private market investors are valuing Robinhood 10x higher than the public markets are willing to value Square’s Cash App, despite a user base that is more than 75% smaller, little or no network effects, higher customer acquisition costs, a CEO with questionable views on regulation, and revenues dependent on just one service: trading stocks and cryptocurrencies.

Unlike Robinhood, Cash App is building out a diversified digital wallet with a number of features already activated: peer-to-peer payments, bitcoin purchase and sale capability, direct deposits, and a debit card with rewards. Given its announced acquisition of brokerage application protocol interface (API) company Third Party Trade this week, Square also could save some back-end costs that Robinhood pays to intermediaries and technology providers. Moreover, as others have pointed out, this new feature could be integrated into Square’s merchant business, offering 401Ks and other products to more than 2 million merchants and their employees, many of whom already are serviced with Square’s Payroll product.

[1] We derive a valuation of roughly $120 per Cash App user from adjusting Square’s market capitalization to Cash App. That is dividing the market capitalization by the ratio between Cash App’s revenue to Square’s total revenue, and then dividing this Cash App-adjusted market capitalization by our estimate of active Cash App users. While the public equity market generally has trouble valuing Cash App, this is one possible approach to assess the portion of Square’s market capitalization that is attributable to Cash App.

[2] Estimate based on ARK research.

[3] Robinhood had 6 million users at the of 2018 according to reports. However, fintechs mostly report the number signups, not actives, as users, and given a churn rate, we believe their Q2 active users to be approximately 5 million.

Facebook’s Libra Faces an Intensified European Backlash

Follow Yassine on Twitter @yassineARK

France’s Minister of Economy and Finance, Bruno Le Maire, stated that France will halt Libra’s development in Europe because it threatens the “monetary sovereignty” of governments. At the opening of the 2019 Organisation for Economic Co-operation and Development’s (OECD’s) Global Blockchain Policy Forum, Le Maire declared, “I want to be absolutely clear…. In these conditions, we cannot authorize the development of Libra on European soil.”

The Libra Association may have provoked La Maire’s comments after it approached Switzerland’s financial regulator, FINMA, and expressed an interest in gaining a license for mobile payments. Headquartered in Switzerland, the Libra Association may have some protection from French and other European regulators, but their increased scrutiny suggests that the odds of a Libra launch in 2020 have diminished.

Head of Policy and Communications for the Libra Association, Dante Disparte, responded, “The comments from France’s Economy and Finance Minister further underscore the importance of [Libra’s] ongoing work with regulatory bodies and leadership around the world. In the nearly three months since the intent to launch the Libra project was announced, [Libra has] become the world’s most scrutinized fintech effort. [Libra] welcomes this scrutiny and has deliberately designed a long launch runway to have these conversations, educate stakeholders and incorporate their feedback in [its] design.”

Despite Disparte’s conciliatory remarks, other countries have echoed France’s concerns. Germany, for instance, announced that it will "not allow market-relevant private stablecoins." Even if they cannot stop Libra’s development, regulators could make them prohibitively difficult to use in their respective jurisdictions.