Facebook Acquires Mind Control Startup CTRL Labs

Follow James on Twitter @jwangARK

Hailed several years ago as the successor technology to smartphones, virtual reality (VR) and augmented reality (AR) have failed to gain mainstream adoption. A key obstacle is the user interface: it’s not intuitive. While PCs have the mouse and keyboard and smartphones a multi-touch display, VR and AR headsets have no real input device. To address this issue, Facebook offered nearly $1 billion this week for CTRL Labs—a startup that has designed a wristband that lets users control devices with their minds.

CTRL-Labs’ wristband uses a technology known as differential electromyography, or EMG. EMG captures electrical signals as muscles begin to activate when an individual intends to move. Already in developers’ hands, the prototype can translate actual or intended hand motion into digital actions, such as jumping over obstacles and shooting at asteroids. CTRL uses artificial intelligence to learn how different user intents map into unique electrical signals.

If successful, EMG-based control technology and Elon’s Musk’s Neuralink could close the gap between thought and input, paving the way for entirely new classes of computers that we can’t imagine today.

The Amazon Hardware Event Unveils Frames, Buds, Loop and More…

Follow Nick on Twitter @GrousARK

On Wednesday at its annual hardware event, Amazon announced more than 15 new devices. With products ranging from smart glasses to a 4-in-1 smart oven, it did not disappoint.

While most of the use cases centered on the home, Alexa - Amazon’s voice assistant – arguably made the most notable leap, outside of the home. The initial announcements featured Amazon’s highly anticipated headphones: with a price tag of $129.99, Bose noise-canceling technology, and Alexa integration, its new Echo Buds now seem to be a formidable competitor to Apple’s AirPods. In a Steve Jobs-like “one more thing” moment, however, Amazon one-upped the earbuds announcement with two new products that no one expected: Echo Frames (Glasses) & Echo Loop (Ring). Through Alexa, they will allow users to stay connected to Amazon on the go, enabling it to recapture mobile users, an opportunity the Fire Phone missed.

Given Amazon’s success in the smart home market, perhaps competitors like Apple should be concerned. Amazon now owns a majority share of the smart speaker market and could penetrate 50% of US households by mid-2020. It also is enjoying success in other areas like home security (Ring) and entertainment (Fire TV). Amazon’s apparent dominance in the home bodes well for its new wearables business with Alexa the hub for all of its devices.

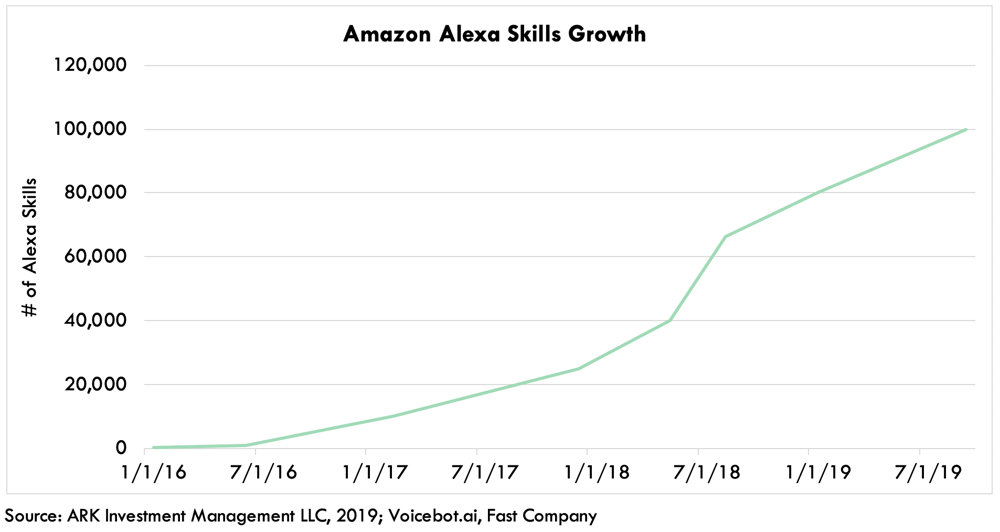

Amazon offered more perspective on Alexa’s success at Wednesday’s event. It now offers 100,000 skills, apps designed to work with the voice assistant, and is compatible with roughly 85,000 different devices.

How Will the SAFE Banking Act Impact Financial Services?

Follow George on Twitter @GeorgeOfARK

Marijuana sales are legal in some form in 33 states but most if not all marijuana-based businesses are not able to access basic financial services because the Drug Enforcement Administration (DEA) classifies marijuana as a Schedule I drug. This classification prevents banks, processors and sometimes local businesses such as plumbers and electricians from working with and in marijuana-based businesses, forcing them into cash-based transactions as a means of payment should they decide to do so. Last year, marijuana sales in the US were $11 billion, with estimates in the $30 billion range for 2024.

On Wednesday, the House of Representatives voted on and passed the Secure and Fair Enforcement (SAFE) Banking Act by a vote of 321 - 103. The bill now is heading to the Senate where it faces an uncertain future. If this bill were to pass in the Senate, the financial services industry would be able to serve the marijuana industry without violating any federal laws, likely expanding the market beyond $30 billion by 2024.

ARK's finch research has focused importantly on the un(der)banked population in the US. Rarely have we found an industry in the developed world that the financial services industry appears to have ignored entirely. We believe that cash based businesses are inherently inefficient. For example, they have to hire security and/or store physical dollars in safes and can’t use traditional payroll services. If the Senate were to pass SAFE, companies like Square, PayPal, and Intuit could benefit from a new market opportunity. As a point of reference, last year Square processed nearly $85 billion, so even capturing 10% of a potential $30+ billion market would have a meaningful impact.

Bitcoin’s Hash Rate Dropped 40%. Or Did It?

Follow Yassine on Twitter @yassineARK

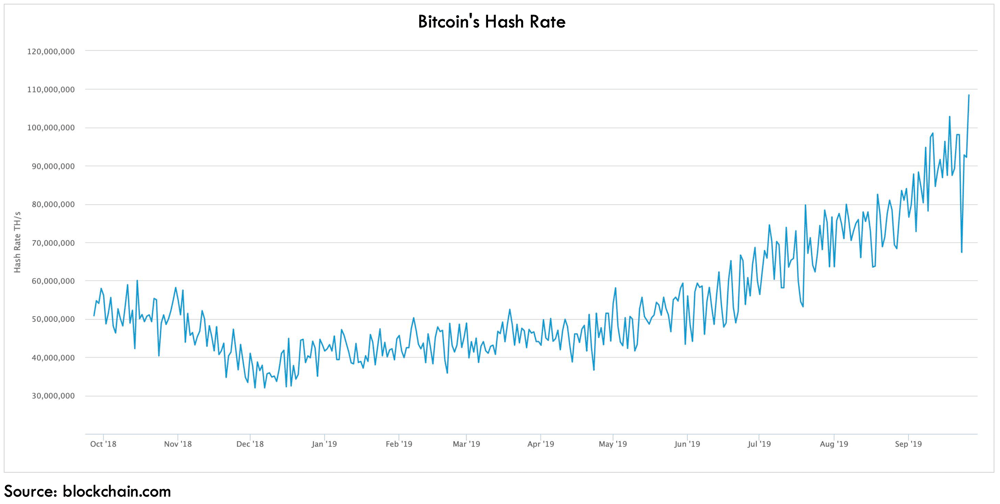

Bitcoin’s 20% price sell-off is breeding fear, uncertainty, and doubt (FUD) once again. This week, news broke that Bitcoin’s hash rate had dropped more than 40%, raising the profile once again of blockchain’s “fundamental technical issues”.

Upon further analysis, the precipitous drop in Bitcoin’s hash rate seems to have been misinterpreted. An understanding of the hash rate calculation suggests why.

A common misconception is that the hash rate can be calculated with precision at any point in time. In reality, Bitcoin’s hash rate is an estimation based both on the mining difficulty and the mining frequency of previous blocks. Knowing the difficulty, one can estimate the hash rate needed to mine a certain number of blocks during a period of time.

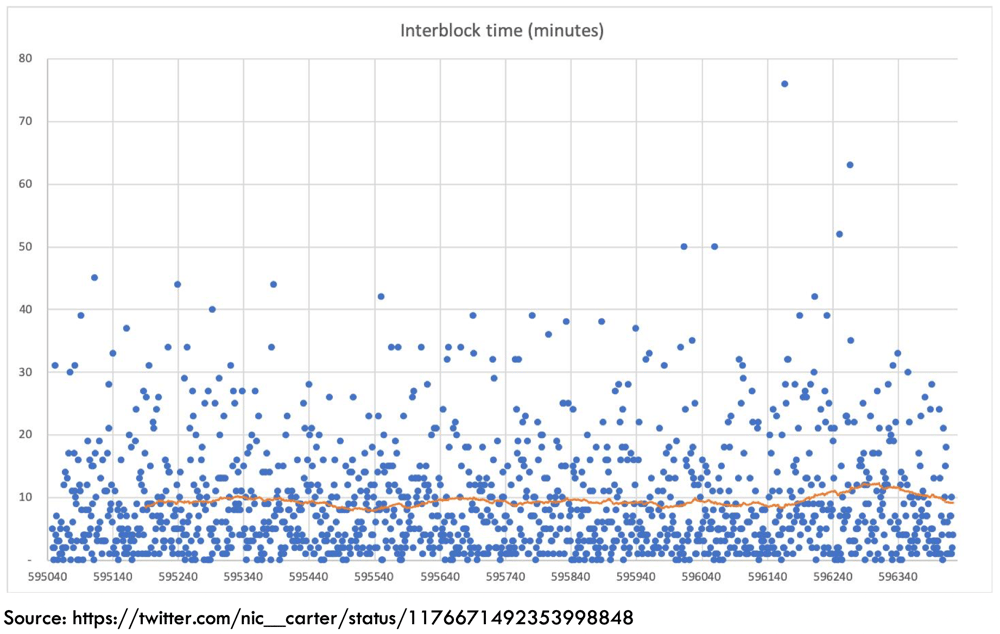

Additionally, block times themselves are probabilistic and prone to a high degree of variance. Below is a graph courtesy of Nic Carter illustrating the time between blocks mined over the last thousand blocks. The outliers are notable.

This week, for example, 5 blocks took longer than 50 minutes to mine. Estimating the hash rate based on those 5 blocks would have suggested a significant drop in hash rate. While unusual, a high variance in block times is possible given their probabilistic occurrence.

As Jameson Lopp states, “It was just regular random fluctuations in block times. The longer time period over which you estimate hash rate, the more accurate your estimate is likely to be... and vice versa.”

The day after the precipitous drop, the estimated hash rate surged to all-time highs, another example of the skewing associated with a single day’s worth of data. One day does not a trend make.