According to our research, Square Cash App’s viral customer acquisition strategy has collapsed its cost of customer acquisition relative to that of traditional financial institutions. With an expanded menu of products beyond peer-to-peer payments and debit cards, Cash App profits per user could surpass those of banks.

One of the leading consumer finance applications in the US, the Cash App has been the top download in the Apple App Store’s personal finance category for several months. According to our estimates, the Cash App’s active user base is catching up to that of Venmo, PayPal’s peer-to-peer payments application.

While we believe both are taking share from traditional financial institutions, Venmo may be losing momentum relative to the Cash App because of privacy concerns. Venmo’s ‘public by default’ privacy policy has caused much criticism. In contrast, the Cash App does not disclose user transactions and uses Twitter campaigns, podcasts, and other viral channels to drive community-focused partnerships.

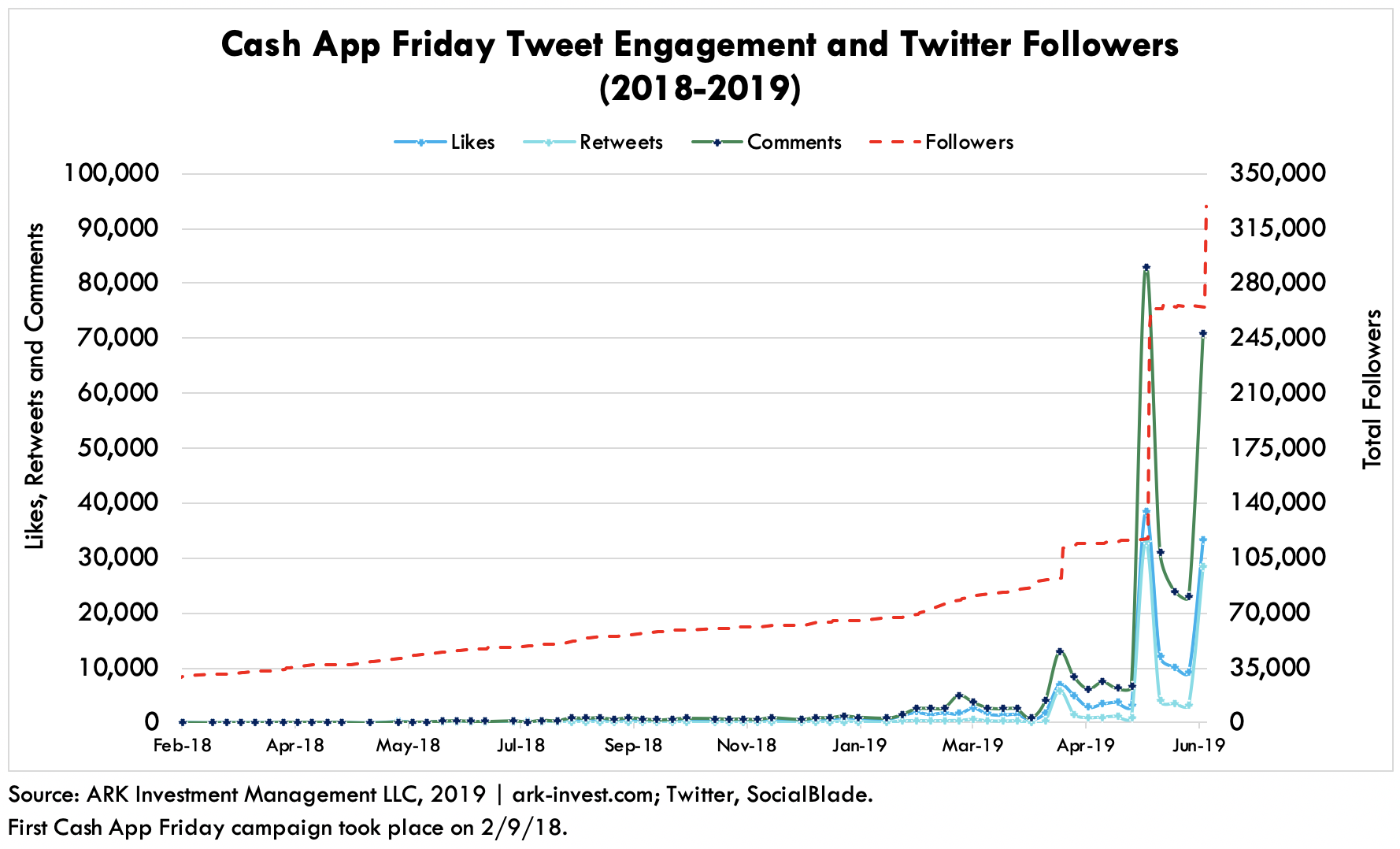

Cash App runs its own marketing campaign on Twitter called Cash App Fridays. On Cash App Friday, users reply to the Cash App’s tweets with their Cash Tags and receive funds if selected by its marketing team. On so-called Super Cash App Fridays, the Cash App gives out larger amounts of money, like $10,000 on May 24, 2019 and June 21, 2019. Started in 2017, Cash App Fridays evolved slowly for two years until engagement increased sharply this year. As can be seen in the chart below, likes, retweets and comments in response to the Cash App Friday tweet spiked with the first $10,000 giveaway, which was the first time the Cash App stated the amount of the giveaway. More than 80,000 users commented on the May 24 tweet and 70,000 during the second $10,000 giveaway on June 21, 2019. The chart also illustrates the close correlation between Cash App Friday campaigns and the number of Cash App followers.

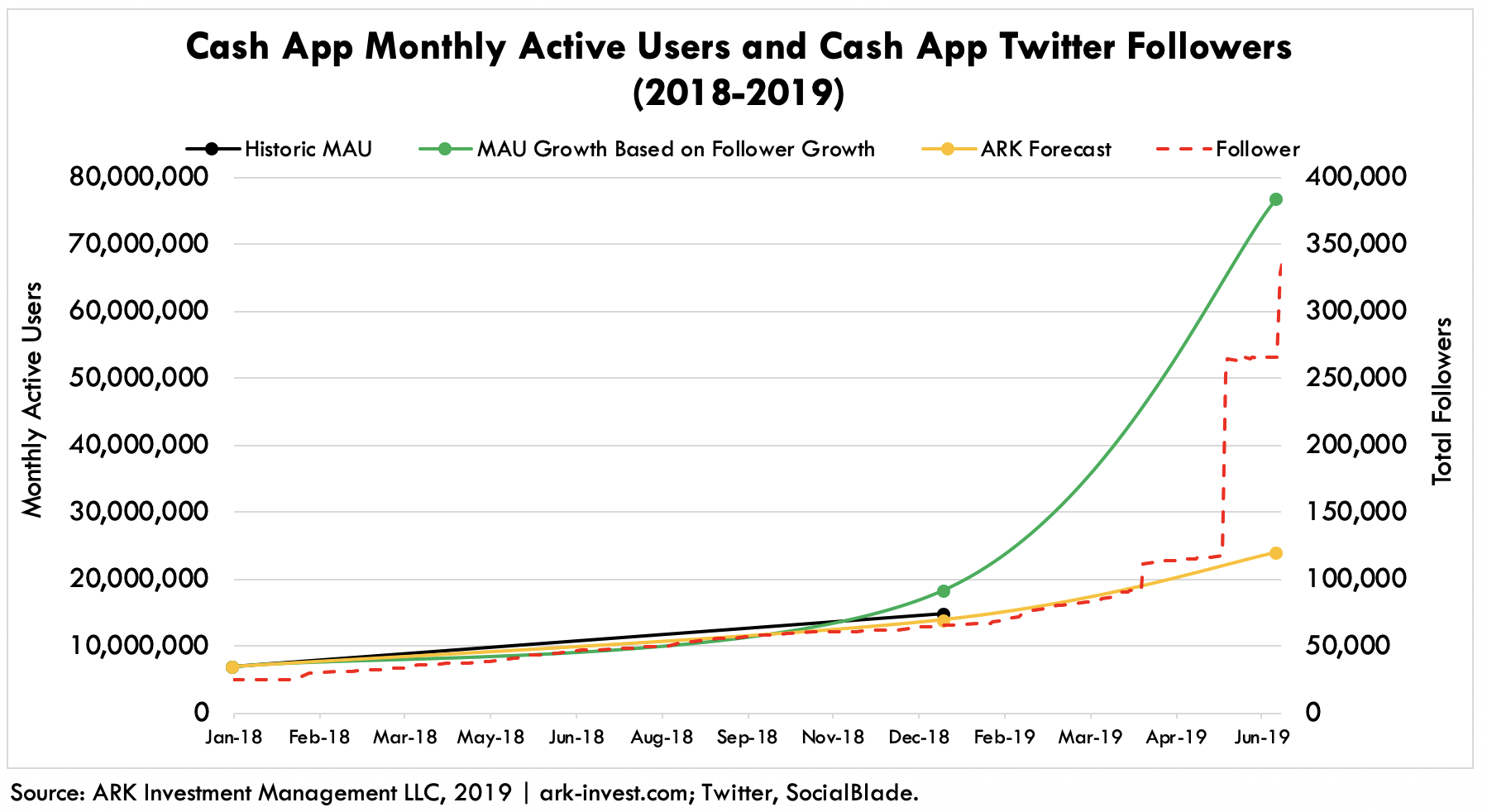

The Cash App’s Twitter follower growth rate in 2018 also was close to that of its Monthly Active Users (MAU), as can be seen in the chart below. In 2018, Cash App Twitter followers grew from 24,700 to 65,300, while Monthly Active Users increased from 7 to 15 million, even higher than our estimate of 14 million. While it’s unlikely that the near-linear relationship between Cash App Twitter followers and Monthly Active Users will prevail in 2019, we believe that Cash App’s accelerated marketing efforts did have a positive effect on user acquisition in the first half of 2019.

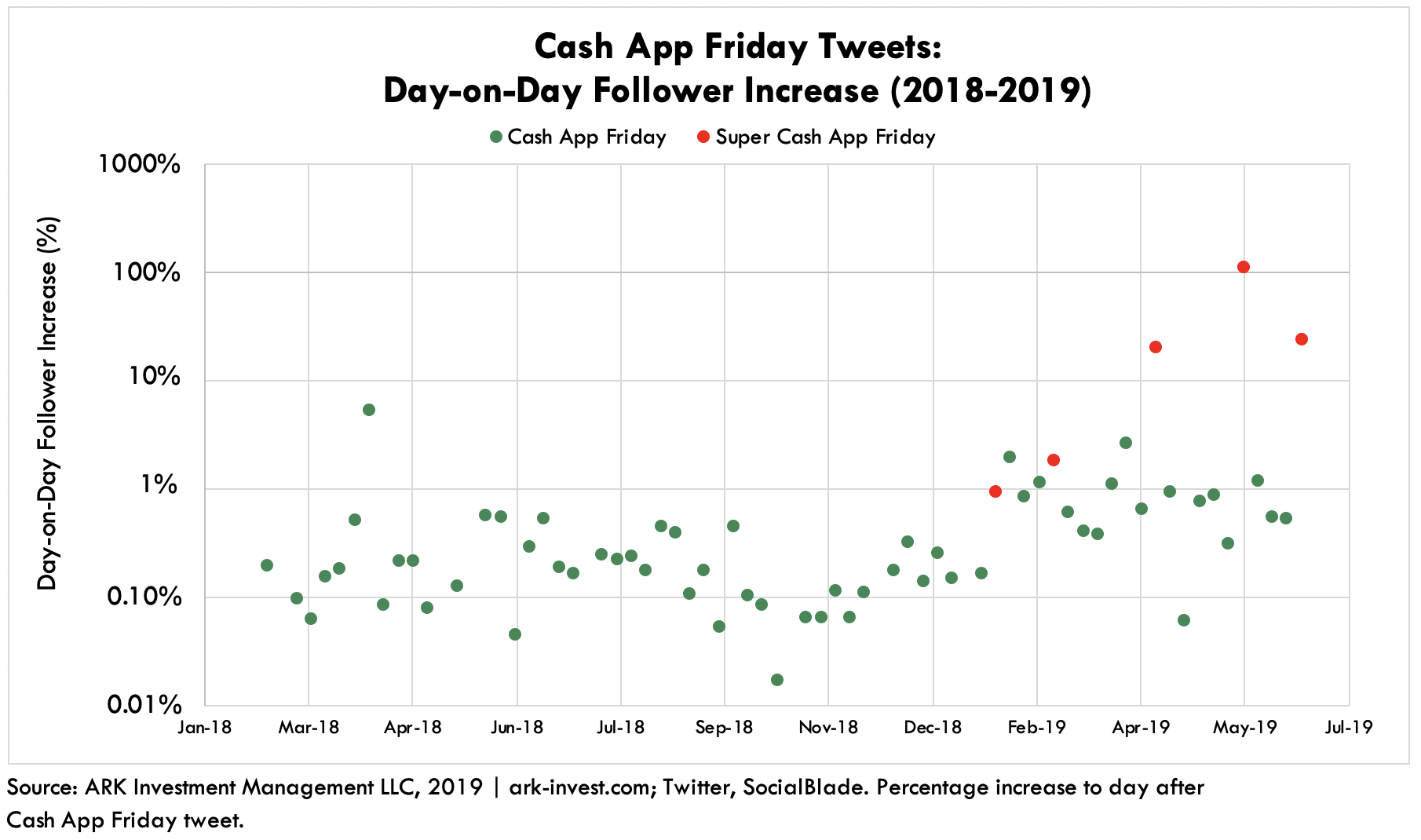

Thus far this year, the increase in Cash App Twitter followers on Cash App Fridays has averaged 7.4%, well above the 0.3% increase on average last year. As shown in the chart below, one day after the Super Cash App Friday on May 24, the Cash App’s Twitter follower base more than doubled with 134,770 new followers.

The fact that the Cash App gains a large number of new followers after Cash App Friday, especially Super Cash App Friday, supports the assumption that some followers new to Twitter also are new to the Cash App. Apparently, new followers come across the Cash App’s Twitter campaign, download the app, take part in the Cash App Friday lottery, and follow the Cash App account to participate in future giveaways.

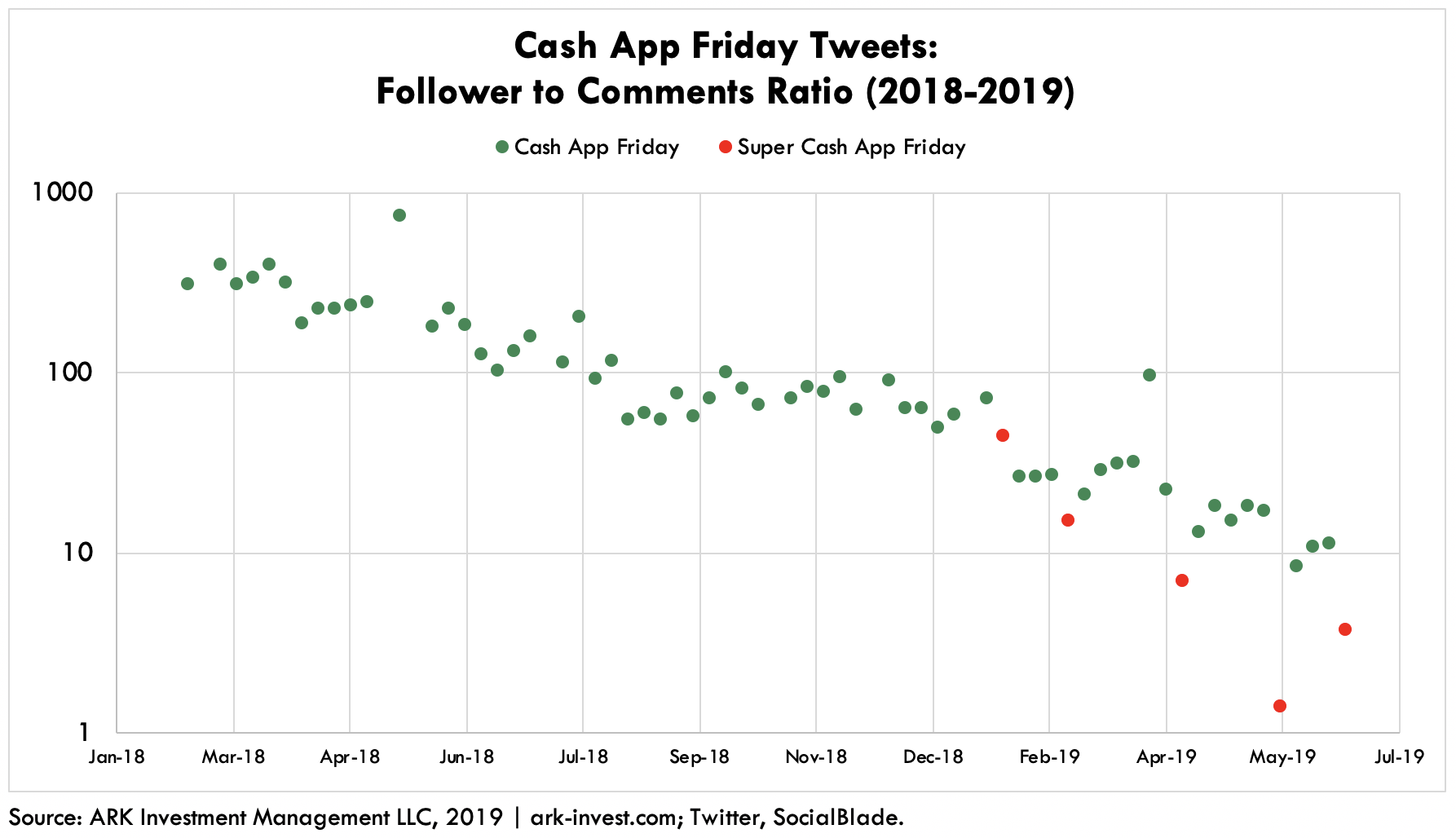

Another measure of engagement is the ratio between followers and comments, as shown below. Of the Cash App’s 39,000 Twitter followers on May 11, 2018, for example, 52 commented on the Cash App Friday tweet, putting the follower to comments ratio above 750. Through 2018 and 2019, that ratio has decreased to 4, suggesting that the Cash App has attracted new and/or existing Twitter follower comments on Cash App Fridays, and increased engagement. Super Cash App Fridays have been particularly effective in driving engagement, as the follower to comments ratio in four of 5 campaigns dropped progressively lower.

Another measure of engagement is the ratio between followers and comments, as shown below. Of the Cash App’s 39,000 Twitter followers on May 11, 2018, for example, 52 commented on the Cash App Friday tweet, putting the follower to comments ratio above 750. Through 2018 and 2019, that ratio has decreased to 4, suggesting that the Cash App has attracted new and/or existing Twitter follower comments on Cash App Fridays, and increased engagement. Super Cash App Fridays have been particularly effective in driving engagement, as the follower to comments ratio in four of 5 campaigns dropped progressively lower.

Interestingly, in a bitcoin-themed equivalent to Cash App Fridays called Stacking Sats,[1] every Saturday, users post a screenshot of their bitcoin purchases on Twitter, encouraging other Twitter users to do the same. Even Square and Twitter CEO Jack Dorsey has participated in such threads.

Besides proprietary marketing campaigns like Cash App Fridays, the Cash App also runs partnered marketing campaigns with brands, podcasts and even e-sport teams. In one example, the Cash App partnered with Burger King on an offer to pay off the student debt of selected Twitter users. Nearly 100,000 users qualified by tweeting their Cash Tags to Burger King.

got student loans? what’s ur $cashtag?

— Stranger King (@BurgerKing) May 22, 2019

Through indirect marketing campaigns, the Cash App is creating a win-win-win for third parties, Cash App users, and the Cash App itself. Third parties engage with their customer bases by offering “free” goods or services through the Cash App, in this case paying off student debt. Users receive free goods or services, like loan payments, and connect with their brands or influencers of choice, in this case Burger King. The Cash App acquires new users without costly marketing campaigns, with the giveaways timed to drive engagement: Burger King’s tweet, for example, appeared only weeks after interest in ‘student loan debt’ reached an all-time high on Google searches and several US presidential candidates highlighted the issue in their 2020 campaign promises. While banks can pay from $350 to $1500 to acquire users, Cash App acquired a new customer through Burger King in five minutes without any direct mail or bank branch visit.

Here @Square @CashApp acquires a new customer.https://t.co/hvZbqqfa4p

A traditional bank pays ~$1,000 for the same.

☄️

?

? pic.twitter.com/L95z2JJwYq— Brett Winton (@wintonARK) May 22, 2019

Square has run similar campaigns with rappers like Travis Scott and Lil B and other influencers, triggering a network effect for the Cash App. With 120,000 replies, Travis Scott’s tweet gained more momentum than Burger King’s. If only 129 of the 120,000 who commented on his tweet were new to Cash App, then Square’s cost of customer acquisition would have been less than the $925 per user that banks pay on average, according to our research, and 6,000 comments, only 5% of the total, would have dropped it to $20. Moreover, as the converted users appear to spread the word on social media, the Cash App can acquire additional users from just one.

Other Cash App sponsors and partnerships include the Joe Rogan Experience podcast, Pod Save America, Barstool Sports’ PardonMyTake podcast, and the e-sports team 100 Thieves. Joe Rogan Experience and PardonMyTake pay $5 when fans sign up for the Cash App and donate an additional $5 to a charity selected by the podcasts.

Thanks to the Cash App’s viral marketing strategy, Square is acquiring users at a large discount to traditional banks’ cost of customer acquisition. As illustrated in a recent blog post, we believe that the lifetime value of users associated with Digital Wallets such as Cash App will be higher than that associated with banks, particularly as Digital Wallet providers expand their product offerings toward traditional banking products. Indeed, as Square recently said, it will “focus on pushing consumers to utilize Square Cash in place of a bank account”.

Banks beware!

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024