Video streaming has changed viewing habits and now is impacting the monetization and valuation of content. Following in the footsteps of broadband and cable, video streaming services are disrupting at-home entertainment. Netflix, Amazon, Disney, and other streaming companies are producing original content financed by monthly subscription fees instead of ticket sales, advertising, and other more traditional monetization strategies.

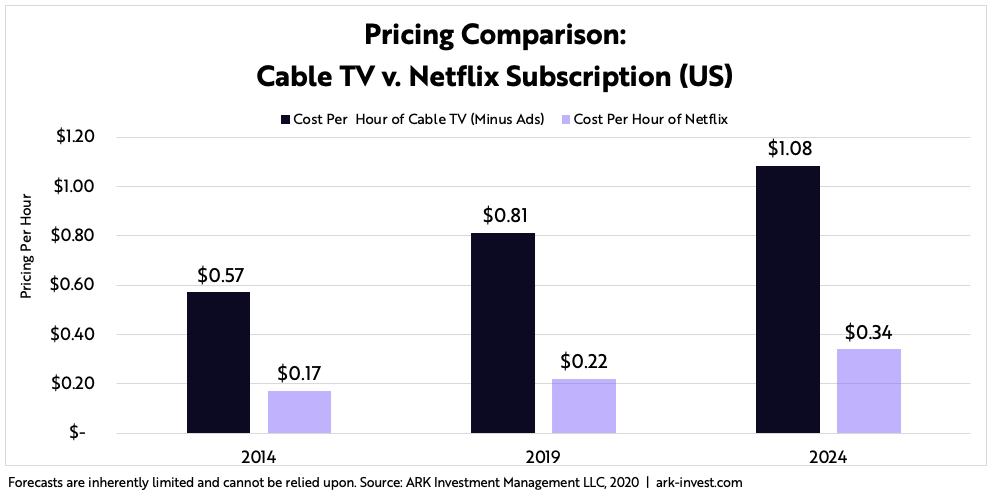

Popularized by Netflix, monthly subscriptions have helped streaming services gain large audiences by undercutting the pricing of traditional content providers. As shown in the chart below, we believe Netflix is providing content at roughly a 70% discount to cable providers. Yet, in the absence of ticket sales or advertising, analysts seem to be finding it difficult to assess the value of its “original content”.

ARK’s research suggests that the global subscription video on demand (SVOD) market will quadruple to roughly $136 billion during the next five years. In 2019, Netflix’s content budget reached $14.6 billion, most of it for the production and acquisition of original content.[1] Likewise, players such as Amazon, Apple, Disney, and AT&T are spending billions on original content for their streaming platforms in the anticipation of handsome returns. Netflix and other players regularly attract millions of subscribers to their original content. In one of the more provocative examples, 57% of Netflix’s subscribers viewed Bird Box within four weeks of its release in 2018.

Despite the significant investment and viewer numbers, little analysis exists on how original content translates into revenues on these streaming platforms. To gain a better understanding, we designed a “calculator”, which can be found here to estimate the revenue generated from each content piece. The variables used to determine profitability include the budgets, hourly monetization rates, and total viewership.

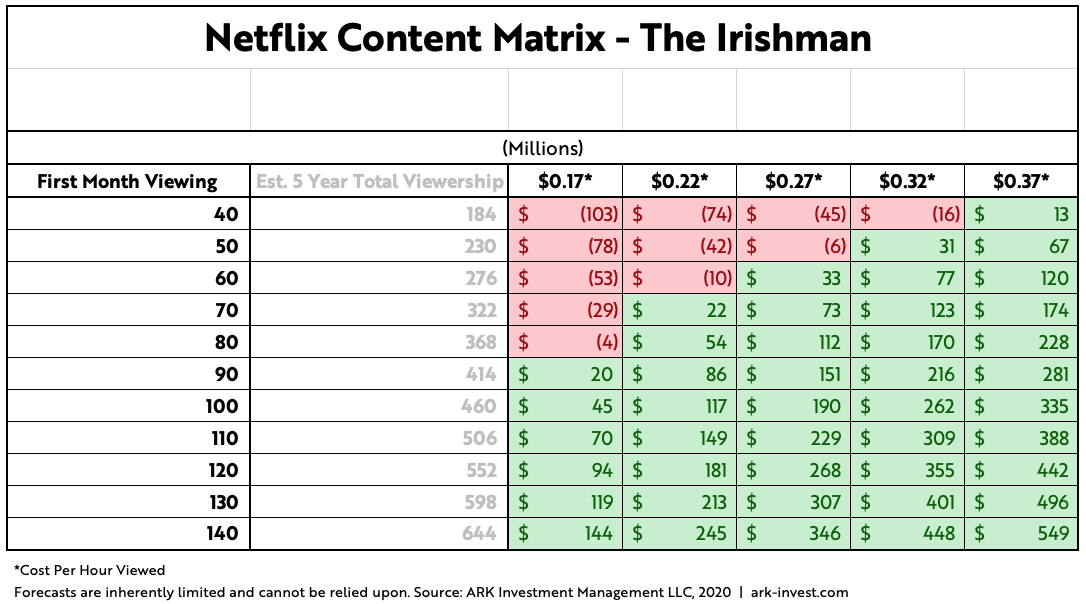

Based on this analysis, we learned that several of Netflix’s high budget blockbuster films – including ‘The Irishman’ – were unprofitable. Netflix spent $175 million to produce ‘The Irishman,’ the most expensive mob movie ever made. Roughly 40 million households, or 25% of Netflix’s subscriber base, viewed the film in its first four weeks on the streaming platform. At its global monetization rate of roughly $0.17 per hour of viewing, Netflix probably did not turn a profit on the 3.5-hour long film in its first year.[2] As shown in the graphic below, Netflix’s pricing would have had to double to roughly $0.32 per hour viewed for ‘The Irishman’ to achieve profitability.

That said, even if unprofitable in the short term, Netflix seems to have good reason to bet on such blockbuster films. The Irishman received 10 Oscar nominations which not only attracted new users to the platform but also may have convinced Hollywood and other talent to sign with Netflix.

Without those ancillary benefits, however, what could Netflix do to increase the profitability of such blockbuster films? As competitors stream into the space, pricing cannot be the answer. Disney, Amazon and Apple all have discounted their subscriptions. Deriving most of its revenue from streaming and carrying a hefty debt burden, Netflix cannot afford to engage in a price war.

If Netflix continues to grow its subscriber base, content such as ‘The Irishman’ could be profitable even without price increases. ARK estimates that Netflix will double its subscriber base by 2023. As shown in the matrix below, if Netflix were to double its subscriber base and still attract more than 50% of its viewers, ‘The Irishman’ would be nicely in-the-black, even at current pricing schedules.

Trying to attract theater interest in its films, Netflix has chosen to operate with one hand behind its back compared to its competition. While Netflix offers all comers movies at the same price, HBO and others are willing to let superfans pay more—roughly $4 per hour (popcorn not included!)—to view content two months before it appears on streaming channels. Netflix has refused to force its subscribers to wait two months, and theatre chains refuse to carry movies without a two-month window. According to our research, Netflix is willing to sacrifice roughly 40% of the net revenues that it could generate from theaters.

Among possible solutions to this segmentation problem could be a premium tier service with early access to highly anticipated movies and shows, or more control through the purchase outright of a national movie theatre chain. Interestingly, Netflix recently signed a lease to run the Paris Theatre in New York City and bought the Egyptian Theatre in Hollywood, moves that caught many off guard. Now it has the flexibility to test content segmentation strategies as well as subscription bundling and pricing.

Even without those segmentation strategies, Netflix is in good shape. With a global footprint, it reaches millions of potential subscribers which should translate into profitability for its original content, if not over the short term, then over the long term.

To experiment with our “calculator”, please follow the link above and tweet any interesting discoveries!

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024