UPDATE: This article has been updated as of October 17, 2016.

The automotive industry is approaching a profound inflection point: by 2022 the demand for electric vehicles [1] (EVs) will begin to outpace that for gasoline powered cars. As the cost of lithium-ion cells falls faster than most analysts have anticipated and the cost to manufacture traditional Internal Combustion Engine (ICE) powertrains increases, ARK Invest’s analysis suggests that 200-mile range EVs will be cheaper to the consumer than the majority of ICE vehicles within five to seven years. If 200-mile range EVs accommodate the travel needs of 80% of Americans, then current forecasts significantly understate the demand for EVs in 2020.

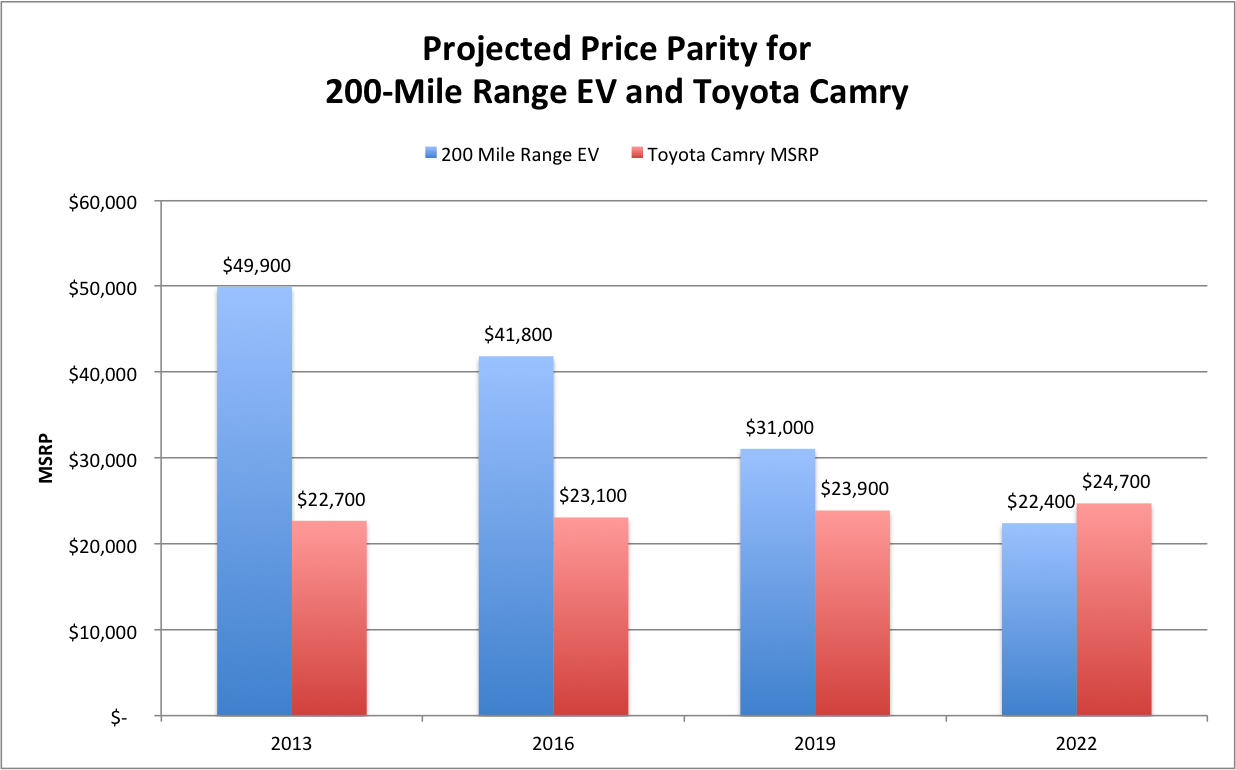

Accounting for roughly 20% of the total cost, battery costs are critical to future EV adoption. As lithium-ion battery prices decline during the next few years, ICE powertrains, which also account for roughly 20% of the cost of those vehicles, will rise primarily because of stricter efficiency and emission regulations. Currently, EVs sell at a premium to comparable ICE vehicles, but ARK anticipates that a 200-mile range EV with the same amenities as today’s best-selling Toyota [TM] Camry will sell at a lower price point in 2022, as shown below.[2]

Source: NADA Guides, ARK Investment Management LLC

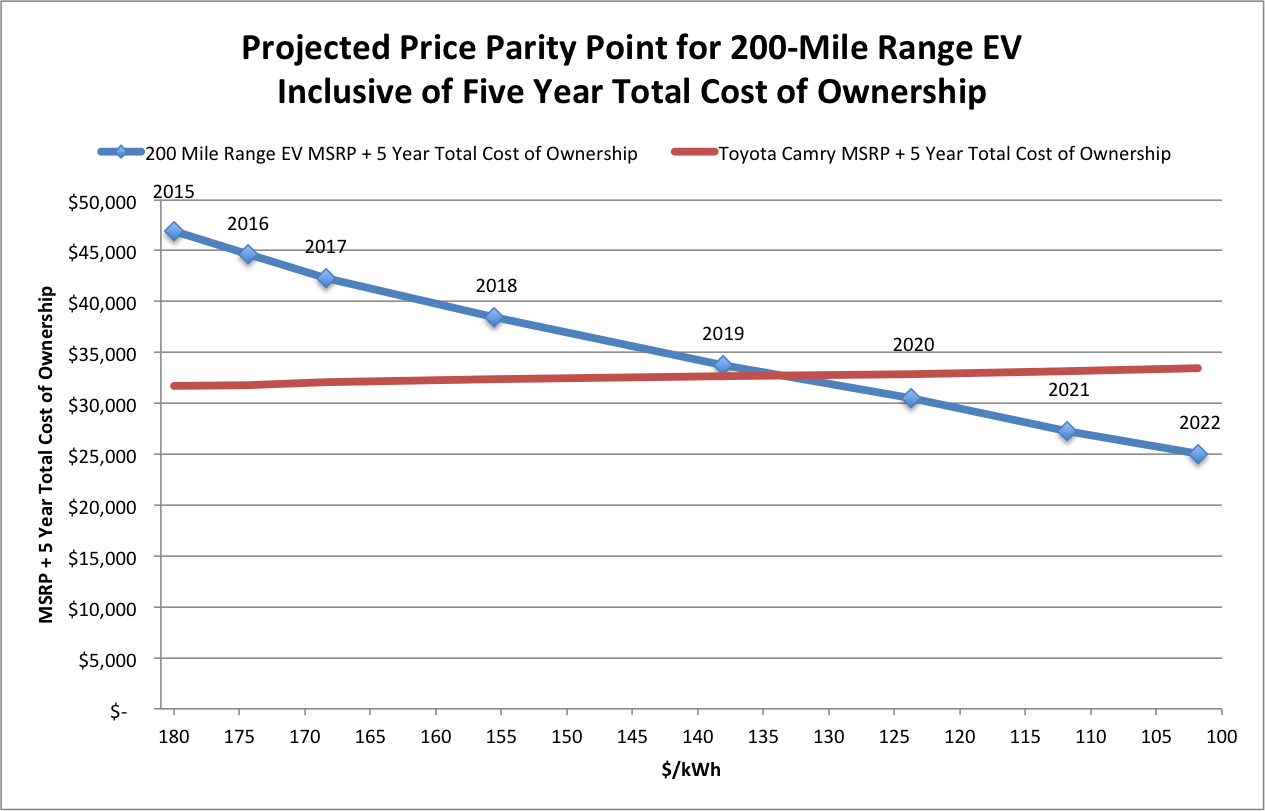

Incorporating the EV savings associated with lower maintenance and fuel costs, ARK anticipates that the crossover point will occur even sooner, perhaps before 2020, as is illustrated below.

Source: NADA Guides, ARK Investment Management LLC

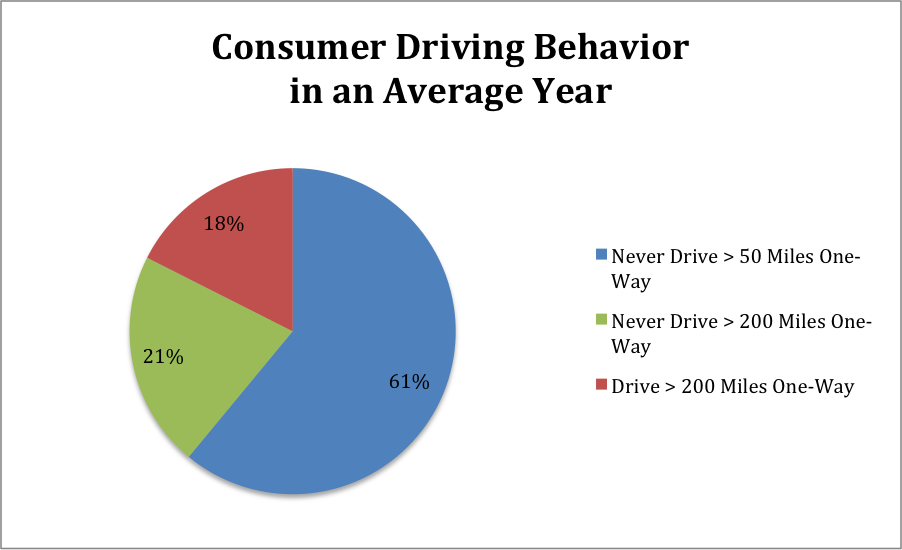

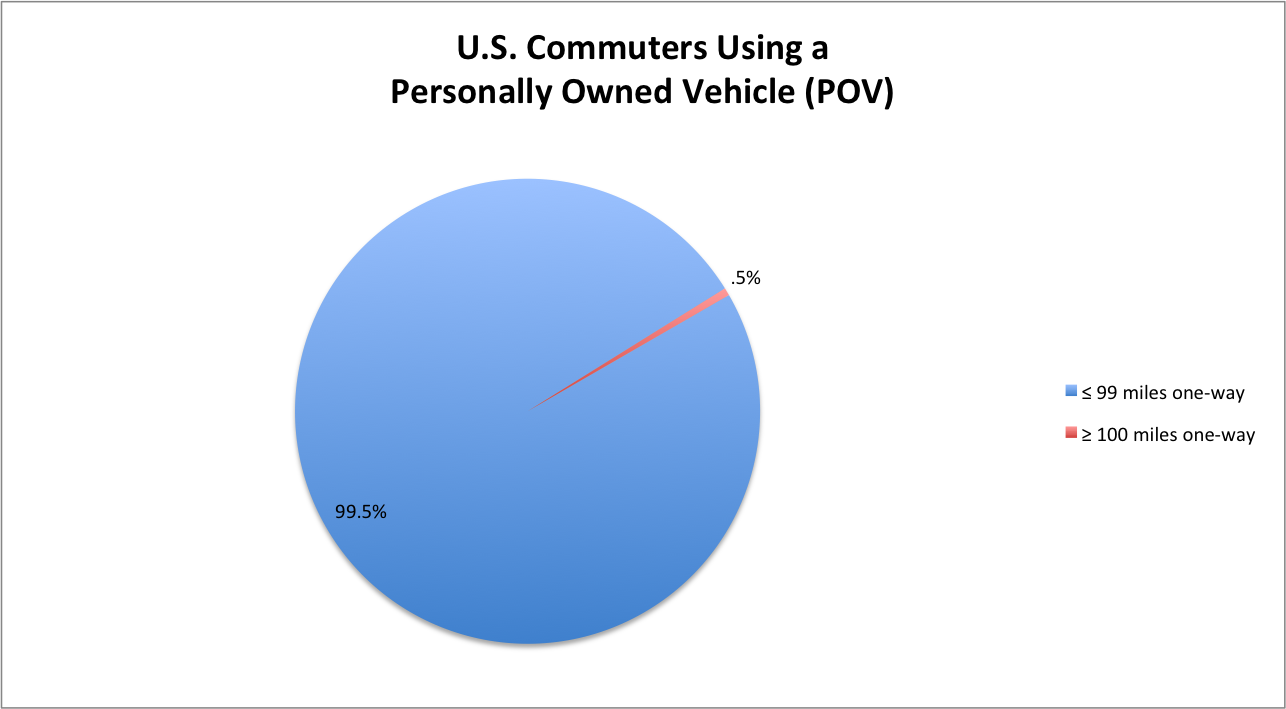

Major auto manufacturers have focused their research and development efforts on a 200-mile range EV for a reason. As shown below, roughly 60% of the U.S. population does not travel long distance in an average year. Among those consumers who do, more than half travel fewer than 200 miles per trip. Meanwhile, among those commuting with a personally owned vehicle (POV), 99.5% travel fewer than 99 miles one-way. Consequently, a 200-mile range EV could accommodate roughly 80% of the U.S. population’s travel needs and prove sufficient for nearly every commuter with a POV.

Source: U.S. Department of Transportation, ARK Investment Management LLC

Source: U.S. Department of Transportation, ARK Investment Management LLC

Source: U.S. Census Bureau, U.S. Department of Transportation, ARK Investment Management LLC

Source: U.S. Census Bureau, U.S. Department of Transportation, ARK Investment Management LLC

Based on ARK Invest’s research, a 200-mile range EV will be comparable in price and feature-set to a Toyota Camry by 2021, after which time EVs will extend their competitive advantage. In 2022, ARK expects the cost of a 200-mile EV to drop below $23,000 placing it at a lower price point than 50% of passenger cars sold in the U.S. and just under 50% of those sold globally. Once EVs and ICE based cars reach price parity, the adoption of EVs should accelerate rapidly.

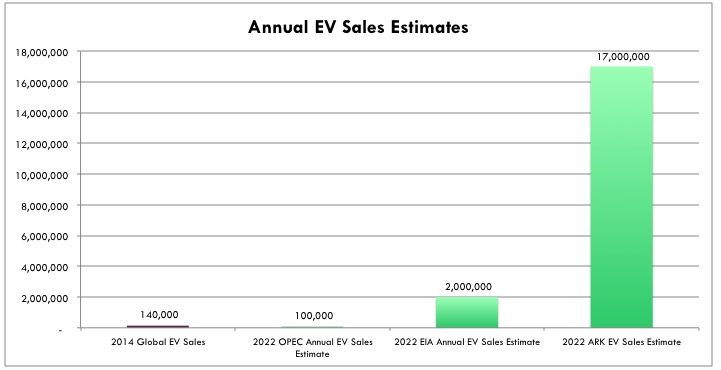

Based on their forecasts, however, many well-known institutions are not anticipating that EVs will reach price parity or achieve broad adoption. OPEC and the EIA [3] have projected that EV sales will stay roughly flat at 100,000 or grow modestly to 2,000,000 units, respectively, over the next ten years. In contrast, according to ARK’s analysis, annual sales for EVs will approach 17 million units in the early 2020s, as shown below.[4]

Source: International Energy Agency, OPEC, Energy Information Administration, ARK Investment Management LLC

Source: International Energy Agency, OPEC, Energy Information Administration, ARK Investment Management LLC

While auto manufacturers such as Tesla [TSLA], BMW [BMW], Nissan [NSANY], Fiat [FCAU], and GM [GM] have committed to volume EV production during the next few years, others are beginning to sense the opportunity. Ford [F], Volkswagen [VOW.F], Mercedes [DDAIF], Porsche [POAHF], and others are beginning to discuss volume production. Given the significant demand that ARK anticipates, EV adoption is likely to be supply constrained. Based on known battery factory expansion plans through 2020, production will be able to satisfy fewer than 1.3 million 200-mile EVs. As the true scope of the opportunity becomes clear, ARK expects companies like Tesla [TSLA], Panasonic [PCRFY], Samsung [SSNLF], LG Chem [LGCLF], and GS Yuasa [GYUAF] to invest aggressively and fill the void.

In a supply-constrained market, the winners are likely to be auto manufacturers with EV manufacturing and design expertise, battery manufacturers able to capitalize on the opportunity, and consumers benefiting from better performing cars at lower price points. Needless to say, oil and oil service firms will be vulnerable to a substantial and prolonged decline in global oil demand.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024