Technology Could Boost the NPV of Biopharmaceutical Pipeline Assets Significantly

Emerging technologies like gene editing, gene therapy, artificial intelligence (AI), and next generation sequencing (NGS) should continue to improve clinical trial success rates, increasing the percentage of drug candidates that commercialize successfully. If so, we believe investors relying upon historical success rates are likely to undervalue biopharmaceutical pipeline assets, particularly those at early stages.

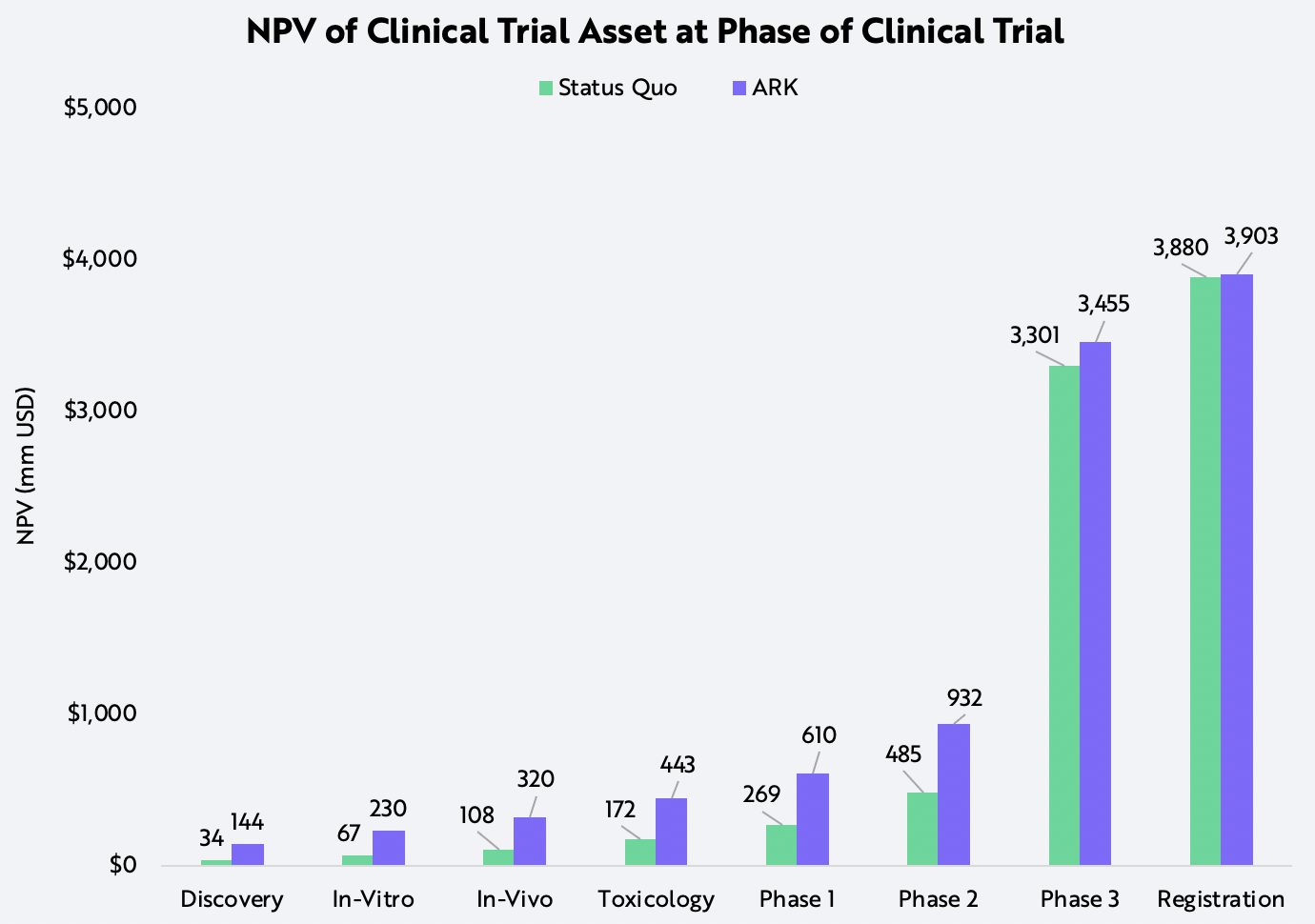

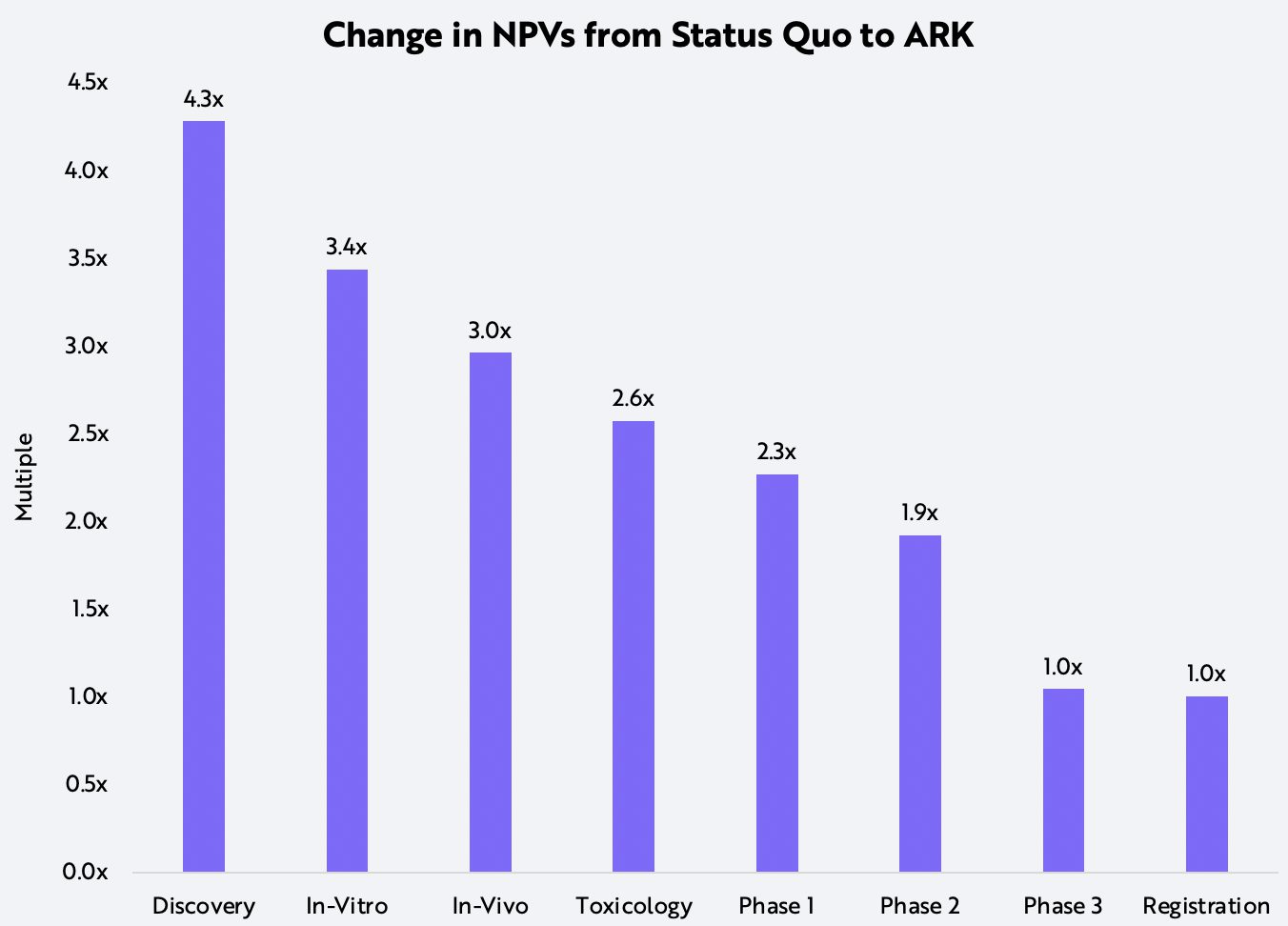

After researching the technology-based improvements likely at each stage of the clinical trial process, ARK has compared the difference in net present values (NPVs) between pipelines based on historical success rates to those on potential success rates. Particularly at the early stages of clinical trials, technological breakthroughs are likely to improve not only failure rates but also times to market, resulting in NPVs two to four times those in consensus forecasts, as shown below.

Assumptions: 15% discount rate at all phases except for registration, which has a 3% discount rate, $1B estimated peak sales for non-curative therapies, 70% net margin, 20% tax.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security. Source: ARK Investment Management LLC, 2021

NGS, AI, CRISPR, and other gene therapies are likely to boost the efficiency of clinical trials, shorten development timelines, reduce failure rates, and increase returns on investment. ARK previously demonstrated how the convergence between and among these technologies could increase the effectiveness of the global healthcare system, adding $9 trillion in market capitalization to the biopharmaceutical space during the next five years.

We believe NGS will boost the success of clinical trials by identifying the patients most likely to respond to specific therapies. In phase 3 lung cancer trials, genetic diagnostics could lower therapy failure rates by 45%. In our analysis, ARK has assumed conservatively that the integration of NGS in clinical trials will reduce failure rates at each stage of the clinical development process by 25%.

Because the impact of a 25% improvement in efficiency should compound with every phase of a clinical trial, a drug candidate in the discovery phase would be 2.9 times more likely to commercialize than historically has been the case. In the status quo model, for example, 29 compounds would be necessary to commercialize one drug successfully, as opposed to only 10 compounds in the more efficient model.

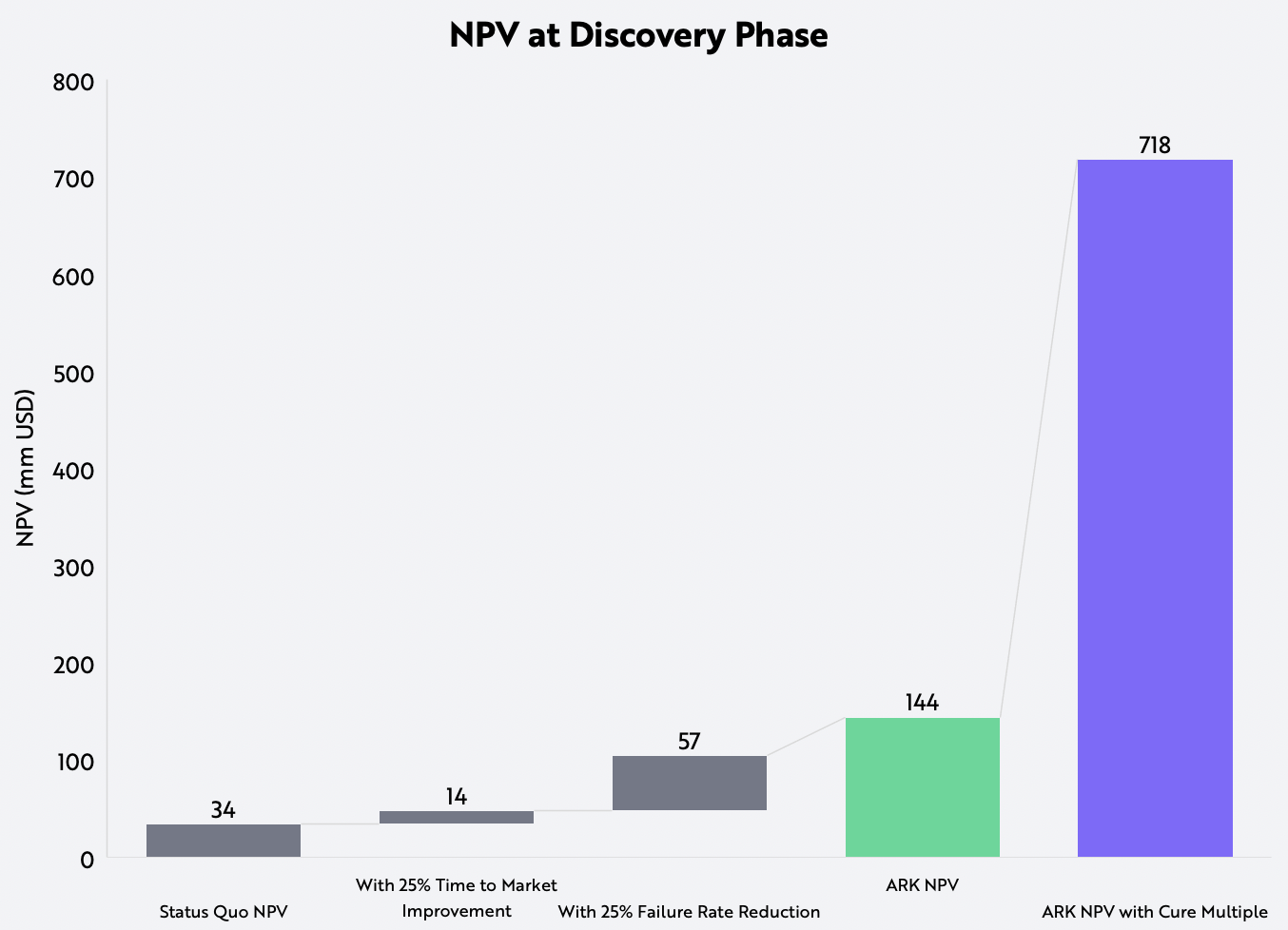

AI could improve the time-to-market for drugs, among other ways by identifying clinical trial sites with the largest relevant patient pools and accelerating recruitment. AI and big data also can serve as synthetic controls in powering studies, reducing costs and time. Integrating AI into discovery platforms and clinical trial databases, companies could reduce time-to-market by 25%, a critical variable in boosting NPVs relative to the status quo, as shown below.

Assumptions: 15% discount rate at all phases except for registration, which has a 3% discount rate, $1B estimated peak sales for non-curative therapies, 70% net margin, 20% tax.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security. Source: ARK Investment Management LLC, 2021

In addition to increasing the odds of commercialization, technology also could enhance the value of drugs. Enabled by gene editing and cell therapies, cures could obviate the need for therapies that treat chronic diseases. We believe a one-and-done drug could displace the many thousands of dollars spent per patient, thus commanding a price that is multiples higher than the annual cost of treatment. The reimbursements for curative treatments like CRISPR gene editing could be five times higher than those for non-curative therapies, generating much higher peak sales and commensurately higher NPVs, as shown below.

Assumptions: 15% discount rate at all phases except for registration, which has a 3% discount rate, $1B estimated peak sales for non-curative therapies, 5x multiple for curative therapies, 70% net margin, 20% tax.

Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security. Source: ARK Investment Management LLC, 2021

Based on our research, biotech companies could harness NGS, AI and curative therapies to accelerate time-to-market by 25% and improve the time necessary for early phase trials by 25%. Increasing their NPV at all phases, especially at the pre-clinical stages responsible for more than 40% of R&D costs, could revalue biopharmaceutical assets significantly during the next five to ten years.

In an upcoming blog, we’ll dimension how technology is likely to reduce costs in the clinical pipeline and increase returns on drug R&D.

Actively Managed Equity

Actively Managed Equity Overview: All Strategies

Overview: All Strategies Investor Resources

Investor Resources Indexed Equity

Indexed Equity Private Equity

Private Equity Digital Assets

Digital Assets Invest In The Future Today

Invest In The Future Today

Take Advantage Of Market Inefficiencies

Take Advantage Of Market Inefficiencies

Make The World A Better Place

Make The World A Better Place

Articles

Articles Podcasts

Podcasts White Papers

White Papers Newsletters

Newsletters Videos

Videos Big Ideas 2024

Big Ideas 2024